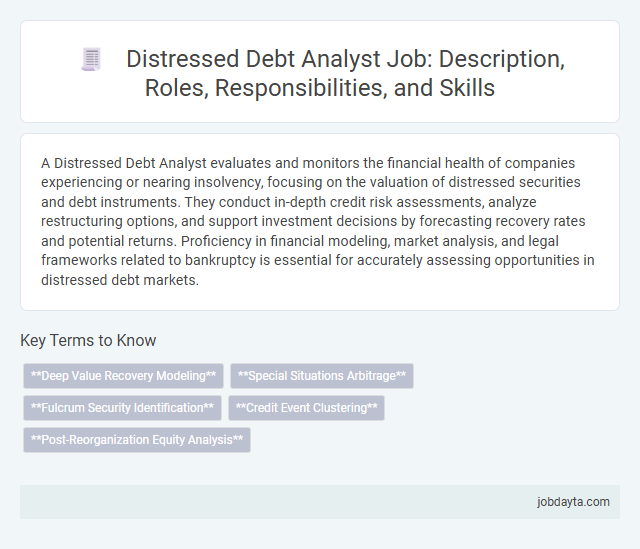

A Distressed Debt Analyst evaluates and monitors the financial health of companies experiencing or nearing insolvency, focusing on the valuation of distressed securities and debt instruments. They conduct in-depth credit risk assessments, analyze restructuring options, and support investment decisions by forecasting recovery rates and potential returns. Proficiency in financial modeling, market analysis, and legal frameworks related to bankruptcy is essential for accurately assessing opportunities in distressed debt markets.

Overview of a Distressed Debt Analyst Role

A Distressed Debt Analyst specializes in evaluating the financial health of companies facing bankruptcy or severe financial distress. This role involves analyzing debt securities, assessing risk factors, and projecting recovery outcomes to guide investment decisions. Expertise in credit markets, valuation techniques, and legal frameworks is essential for accurate distressed asset evaluation.

Key Responsibilities of a Distressed Debt Analyst

A Distressed Debt Analyst evaluates financially troubled companies to identify investment opportunities in their debt securities. Your analysis helps guide strategic decisions in high-risk, high-reward credit environments.

- Financial Statement Analysis - Review and interpret balance sheets, income statements, and cash flow to assess a company's financial health.

- Credit Risk Assessment - Evaluate the likelihood of default and recovery rates for distressed debt instruments.

- Market Research - Monitor market trends and sector-specific developments impacting distressed assets.

Essential Skills for Distressed Debt Analysts

Distressed Debt Analysts require strong financial modeling skills to evaluate troubled companies' debt structures effectively. Proficiency in credit analysis and understanding restructuring processes are crucial for accurate risk assessment.

Expertise in market research enables analysts to identify investment opportunities and potential recoveries. Analytical thinking combined with attention to detail ensures thorough due diligence and informed decision-making in high-stakes environments.

Educational Requirements and Qualifications

A Distressed Debt Analyst requires a strong educational foundation in finance, accounting, or economics to effectively evaluate troubled companies and debt instruments. Advanced analytical skills and relevant certifications enhance the ability to assess credit risks and investment opportunities in distressed securities.

- Bachelor's Degree in Finance or Economics - Provides essential knowledge in financial principles and market dynamics relevant to distressed debt analysis.

- Masters Degree or MBA - Offers advanced expertise in financial modeling, valuation techniques, and strategic management critical for complex decision-making.

- Professional Certifications (CFA, CPA) - Demonstrates proficiency in financial analysis, ethical standards, and specialized skills required for assessing distressed assets.

Analytical Techniques in Distressed Debt Evaluation

Distressed Debt Analysts specialize in evaluating financial securities of companies facing bankruptcy or severe financial distress. Their role requires mastery of analytical techniques that assess the risk and potential recovery value of distressed assets.

Key analytical techniques include cash flow analysis, scenario modeling, and valuation of collateral and claims priority. Analysts examine restructuring plans, legal frameworks, and market conditions to forecast recovery outcomes. This comprehensive evaluation supports informed investment decisions in high-risk environments.

Risk Assessment and Management in Distressed Debt

Distressed Debt Analysts specialize in evaluating and managing the risks associated with high-risk financial instruments. Their expertise is crucial in identifying potential losses and maximizing recovery in distressed debt investments.

- Risk Identification - Analysts assess the likelihood and impact of default or restructuring events on distressed assets.

- Portfolio Assessment - They monitor exposure levels and diversify holdings to mitigate concentration risk.

- Recovery Analysis - Experts estimate potential recovery rates to inform investment decisions and strategy adjustments.

Your ability to interpret complex risk factors directly influences the success of distressed debt investment outcomes.

Financial Modeling and Valuation for Distressed Assets

What key skills are essential for a Distressed Debt Analyst specializing in Financial Modeling and Valuation? Expertise in constructing detailed financial models is crucial for assessing the viability of distressed assets. Accurate valuation techniques help identify investment opportunities and risks in distressed debt markets.

How does financial modeling influence decision-making in distressed debt analysis? Financial models simulate various restructuring scenarios to project cash flows and recoveries. This quantitative insight aids investors in pricing distressed securities and negotiating terms effectively.

What valuation methods are commonly applied to distressed assets? Analysts often use discounted cash flow (DCF), comparables, and liquidation valuations to estimate asset worth under distressed conditions. These approaches reflect different recovery expectations and market realities.

Why is understanding market conditions important for valuing distressed debt? Market volatility and sector-specific risks directly impact asset recovery rates and liquidity. Incorporating macroeconomic data ensures more robust and realistic valuations.

How do distressed debt analysts handle uncertainty in financial forecasts? Scenario analysis and sensitivity testing explore a range of outcomes under different assumptions. This approach highlights potential risks and informs strategic investment decisions.

Career Path and Growth Opportunities in Distressed Debt Analysis

A Distressed Debt Analyst evaluates the financial health of companies facing bankruptcy or severe financial distress. This role requires expertise in credit risk assessment, restructuring strategies, and market trends.

Your career path typically begins with roles in credit analysis or investment banking, progressing to specialization in distressed assets. Growth opportunities include senior analyst positions, portfolio management, and advisory roles in private equity or hedge funds focused on distressed debt.

Tools and Software Used by Distressed Debt Analysts

| Tool / Software | Purpose | Key Features |

|---|---|---|

| Bloomberg Terminal | Financial data analysis and market monitoring | Real-time pricing, distressed debt market data, default probabilities, credit ratings, bond analytics |

| Excel with VBA and Macros | Financial modeling and cash flow analysis | Customizable models for restructuring scenarios, sensitivity analysis, automated reporting |

| Capital IQ (S&P Global) | Company financials, debt structure, and credit risk evaluation | Comprehensive financial statements, covenant tracking, credit scoring, market comps |

| FactSet | Data aggregation and portfolio analysis | Credit risk analysis, distressed securities data, scenario simulations, historical default data |

| Reuters Eikon | Market intelligence and news monitoring | Distressed debt news alerts, market sentiment analysis, pricing data |

| Python with Financial Libraries (Pandas, NumPy) | Advanced data analysis and predictive modeling | Custom algorithms for default prediction, large dataset processing, automation of repetitive tasks |

| Moody's Analytics | Credit risk modeling and scenario testing | Default risk estimates, recovery rate models, macroeconomic scenario integration |

| DebtX | Distressed debt marketplace and transaction data | Pricing analytics, auction data, deal flow information, secondary market insights |

Challenges and Trends in the Distressed Debt Industry

Distressed debt analysts face the challenge of evaluating non-performing assets amidst volatile markets and incomplete financial information. Risk assessment requires advanced modeling techniques to predict potential recovery values accurately. Staying updated on regulatory changes and market trends is essential for maximizing investment opportunities in distressed debt portfolios.

Related Important Terms

Deep Value Recovery Modeling

Distressed debt analysts specialize in deep value recovery modeling by evaluating underperforming assets and complex capital structures to forecast potential recovery rates and optimize investment strategies. Their expertise in financial restructuring scenarios, cash flow projections, and creditor hierarchy assessment enables accurate valuation of distressed securities and identification of high-return opportunities.

Special Situations Arbitrage

Special Situations Arbitrage involves analyzing distressed debt securities of financially troubled companies to identify undervalued assets poised for recovery or restructuring gains. A Distressed Debt Analyst evaluates credit risk, recovery rates, and legal frameworks to construct investment strategies that capitalize on price dislocations and complex insolvency scenarios.

Fulcrum Security Identification

Fulcrum Security Identification involves evaluating distressed debt instruments to determine the most valuable and enforceable claims within a bankruptcy or restructuring scenario. This process prioritizes securities that offer maximum recovery potential by analyzing lien structures, collateral quality, and legal enforceability against the debtor's asset base.

Credit Event Clustering

Credit event clustering in distressed debt analysis identifies patterns of correlated defaults and restructurings within sectors or regions, enhancing risk assessment and portfolio management strategies. This technique leverages historical data and predictive models to anticipate systemic credit events, optimizing investment decisions and mitigating potential losses.

Post-Reorganization Equity Analysis

Post-reorganization equity analysis involves assessing the value and potential upside of equity stakes received after debt restructuring processes, focusing on the company's revised capital structure and market positioning. Distressed debt analysts evaluate financial statements, asset quality, and operational improvements to forecast recovery rates and identify investment opportunities in post-bankruptcy scenarios.

Distressed Debt Analyst Infographic

jobdayta.com

jobdayta.com