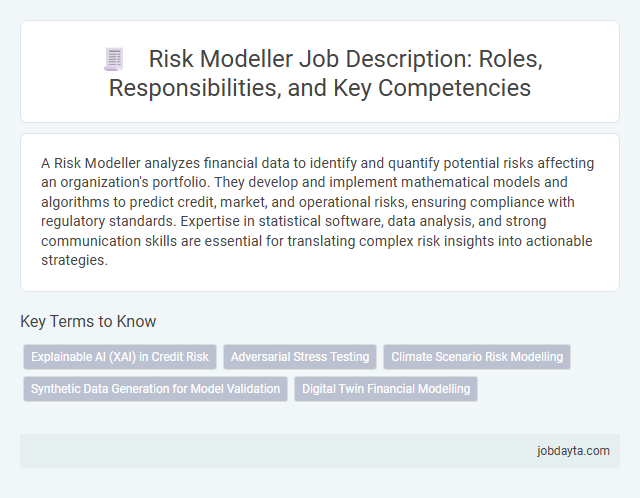

A Risk Modeller analyzes financial data to identify and quantify potential risks affecting an organization's portfolio. They develop and implement mathematical models and algorithms to predict credit, market, and operational risks, ensuring compliance with regulatory standards. Expertise in statistical software, data analysis, and strong communication skills are essential for translating complex risk insights into actionable strategies.

Overview of a Risk Modeller Role

A Risk Modeller analyzes financial data to identify potential risks and forecast their impact on investment portfolios. This role involves developing mathematical models and using statistical techniques to assess credit, market, and operational risks. Your expertise in data interpretation supports strategic decision-making to minimize financial losses and ensure regulatory compliance.

Key Responsibilities of a Risk Modeller

Risk Modellers analyze financial data to identify potential risks that could impact an organization's assets and investments. They develop quantitative models to predict and measure credit, market, and operational risks.

Your key responsibilities include designing risk assessment frameworks and validating model accuracy through rigorous testing. Collaborating with stakeholders to ensure compliance with regulatory standards is essential for effective risk management.

Essential Skills and Competencies for Risk Modellers

Risk modellers play a critical role in identifying, assessing, and mitigating financial risks using quantitative methods. Mastering essential skills and competencies enables them to develop robust risk management strategies and enhance decision-making processes.

- Statistical Analysis Proficiency - Ability to apply statistical techniques to analyze risk data and model potential outcomes accurately.

- Programming Expertise - Proficiency in programming languages like Python, R, or SQL to build and automate risk models effectively.

- Financial Knowledge - Strong understanding of financial markets, instruments, and regulatory frameworks impacting risk assessment.

- Data Interpretation Skills - Competence in interpreting complex datasets to derive actionable insights for risk mitigation.

- Problem-Solving Ability - Capability to identify risk factors and develop innovative solutions to minimize financial losses.

Risk modellers must continuously update their skills to adapt to evolving financial environments and technological advancements.

Educational and Professional Requirements

Risk Modellers require a strong foundation in quantitative finance and data analysis to assess potential financial risks effectively. Your educational background and professional experience play a crucial role in developing accurate risk models for financial institutions.

- Bachelor's Degree in Finance, Economics, Mathematics, or Statistics - This foundational education equips you with essential skills in quantitative analysis and economic theory.

- Advanced Degree or Certification in Financial Engineering or Risk Management - Many employers prefer candidates with a master's degree or certifications like FRM or CFA for specialized knowledge.

- Experience with Statistical Software and Programming Languages - Proficiency in tools such as Python, R, SAS, or MATLAB is vital for building and validating complex risk models.

Tools and Technologies Used in Risk Modelling

Risk modellers utilize advanced tools and technologies to quantify and manage financial risks effectively. These tools integrate statistical methods, machine learning, and data analytics to enhance risk assessment accuracy.

- Statistical Software - Platforms like R and SAS provide robust capabilities for data analysis and predictive modelling in risk assessment.

- Machine Learning Frameworks - Technologies such as Python libraries (TensorFlow, scikit-learn) enable sophisticated pattern recognition and risk prediction.

- Data Management Systems - Tools like SQL databases and big data technologies facilitate efficient storage, retrieval, and processing of large financial datasets.

Importance of Risk Modelling in Financial Institutions

Risk modelling is essential for financial institutions to identify, assess, and mitigate potential losses. It supports informed decision-making by quantifying uncertainties in investment portfolios, credit exposures, and market fluctuations.

Accurate risk models help ensure regulatory compliance and maintain capital adequacy, protecting the institution's financial health. Your ability to implement robust risk modelling enhances overall stability and guides strategic planning in volatile markets.

Types of Risks Managed by Risk Modellers

| Type of Risk | Description | Impact on Finance |

|---|---|---|

| Market Risk | Risk arising from fluctuations in market prices, interest rates, and currency exchange rates affecting asset values. | Can lead to significant losses in investment portfolios and trading positions. |

| Credit Risk | Risk of loss due to a borrower's failure to repay a loan or meet contractual obligations. | Affects lending institutions by increasing default rates and impairing cash flow. |

| Operational Risk | Risk resulting from inadequate or failed internal processes, people, or systems. | Can cause financial loss through fraud, system failures, or human error impacting organizational efficiency. |

| Liquidity Risk | Risk that an entity cannot meet short-term financial demands due to inability to convert assets into cash quickly. | May disrupt your ability to finance obligations, causing solvency issues. |

| Regulatory Risk | Risk of financial loss resulting from changes in laws, regulations, or policies affecting the financial sector. | Non-compliance may lead to fines, penalties, or operational restrictions. |

| Reputational Risk | Risk related to damage to a company's brand or public perception. | Can decrease customer trust and result in loss of revenue or market position. |

Career Path and Growth Opportunities for Risk Modellers

Risk Modellers play a critical role in identifying, assessing, and mitigating financial risks within organizations. Career paths typically advance from Junior Risk Modeller to Senior Analyst, Risk Manager, and eventually Chief Risk Officer, with opportunities to specialize in credit, market, or operational risk. Your growth potential is significant, supported by continuous learning in quantitative analysis, regulatory compliance, and advanced modeling techniques.

Challenges Faced by Risk Modellers

Risk modellers in finance confront complex challenges due to the dynamic nature of markets and evolving regulatory requirements. Accurate risk assessment demands the integration of vast, diverse datasets and sophisticated modelling techniques.

One significant challenge is managing data quality and consistency, as inaccurate or incomplete data can lead to flawed risk predictions. Modellers must also navigate the balance between model complexity and interpretability, ensuring results are both precise and understandable to stakeholders. Constantly changing financial instruments and market conditions require continuous model validation and updating to maintain reliability.

How to Write an Effective Risk Modeller Job Description

How can you create an effective Risk Modeller job description to attract top talent? Craft clear responsibilities and required skills focused on risk assessment techniques, data analysis, and financial modeling. Highlight essential qualifications such as experience with statistical software, knowledge of regulatory compliance, and strong analytical abilities.

What key elements should be included to ensure clarity in the job posting? Define the role's impact on risk mitigation and decision-making processes, emphasizing collaboration with risk management teams. Use precise terminology related to quantitative risk evaluation and predictive modeling standards within the finance industry.

Why is it important to detail the tools and technologies used by a Risk Modeller? Candidates need insight into software like SAS, R, Python, or MATLAB to assess their fit for the position. Specify proficiency levels and familiarity with risk analytics platforms to align expectations with your organizational needs.

How does tailoring the job description to your company's risk framework improve hiring outcomes? It ensures candidates understand your unique risk environment, compliance standards, and internal protocols. This alignment attracts professionals capable of driving effective risk modeling tailored to your financial strategies.

Related Important Terms

Explainable AI (XAI) in Credit Risk

Explainable AI (XAI) in credit risk enables Risk Modellers to interpret complex machine learning models, enhancing transparency and regulatory compliance by clarifying decision logic behind credit approval or denial. This approach reduces model risk and builds trust with stakeholders by providing actionable insights into borrower creditworthiness and exposure to potential defaults.

Adversarial Stress Testing

Risk Modellers specializing in Adversarial Stress Testing develop complex scenarios that simulate extreme market conditions to identify potential vulnerabilities in financial portfolios. These models enhance predictive accuracy by incorporating hostile economic shocks, enabling institutions to optimize risk mitigation strategies and regulatory compliance.

Climate Scenario Risk Modelling

Climate Scenario Risk Modelling leverages advanced statistical techniques and climate data to quantify financial risks associated with extreme weather events and long-term climate changes. This approach enables risk modellers to integrate transition and physical climate risks into portfolio management, enhancing resilience and regulatory compliance under frameworks like TCFD and the EU Sustainable Finance Disclosure Regulation (SFDR).

Synthetic Data Generation for Model Validation

Risk modellers leverage synthetic data generation to enhance model validation by creating diverse, representative datasets that mimic real-world financial scenarios without compromising sensitive information. This approach improves the robustness of risk assessment models by enabling thorough testing under varied conditions, ensuring compliance with regulatory standards and reducing overfitting to historical data.

Digital Twin Financial Modelling

Risk Modellers utilizing Digital Twin Financial Modelling create dynamic, real-time simulations of financial systems to predict potential market fluctuations and optimize risk mitigation strategies. This advanced approach integrates AI-driven analytics and historical data, enabling precise scenario testing and adaptive decision-making in volatile financial environments.

Risk Modeller Infographic

jobdayta.com

jobdayta.com