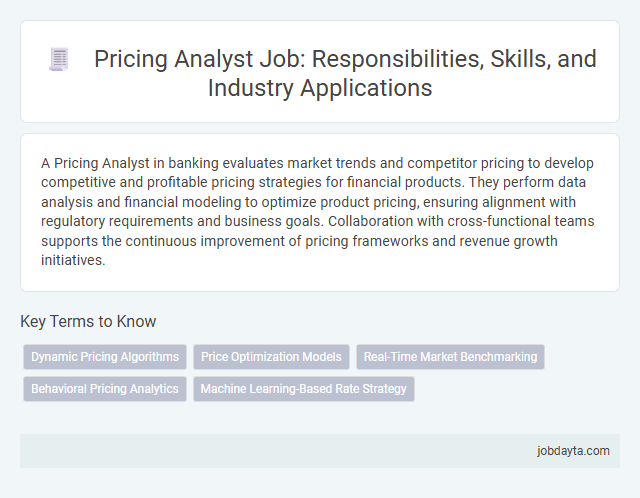

A Pricing Analyst in banking evaluates market trends and competitor pricing to develop competitive and profitable pricing strategies for financial products. They perform data analysis and financial modeling to optimize product pricing, ensuring alignment with regulatory requirements and business goals. Collaboration with cross-functional teams supports the continuous improvement of pricing frameworks and revenue growth initiatives.

Overview of Pricing Analyst Role in Banking

A Pricing Analyst in banking plays a crucial role in determining competitive and profitable pricing strategies for financial products and services. You analyze market trends, customer data, and competitor pricing to optimize revenue and ensure alignment with regulatory requirements. Collaboration with sales, marketing, and risk management teams is essential to develop pricing models that drive growth and maintain market position.

Key Responsibilities of a Banking Pricing Analyst

A Banking Pricing Analyst plays a critical role in developing and optimizing pricing strategies for financial products. Their work ensures competitive yet profitable pricing models that align with market trends and regulatory requirements.

- Market Analysis - Conducts comprehensive research on banking industry trends and competitor pricing to inform strategic decisions.

- Pricing Model Development - Designs and implements pricing frameworks for loans, deposits, and other banking products to maximize revenue.

- Performance Monitoring - Tracks pricing effectiveness and adjusts strategies based on financial performance metrics and customer feedback.

Essential Skills for Pricing Analysts in the Financial Sector

Pricing Analysts in the financial sector must have strong analytical skills to evaluate market trends and competitor pricing effectively. Proficiency in data analysis tools such as Excel, SQL, and Python is crucial for accurate pricing strategy development.

Understanding financial products like loans, securities, and insurance policies helps analysts tailor pricing models to customer needs. Attention to detail and knowledge of regulatory compliance ensure pricing strategies align with industry standards and risk management policies.

Tools and Software Used by Pricing Analysts in Banking

Pricing analysts in banking rely on advanced tools and software to assess market trends and optimize product pricing. Key platforms include Excel for data analysis, SAS for statistical modeling, and specialized pricing software like PROS or Zilliant. Your ability to leverage these technologies enhances accuracy and drives strategic decision-making in a competitive financial environment.

How Pricing Analysts Influence Bank Profitability

How do Pricing Analysts impact the profitability of banks? Pricing Analysts play a crucial role in setting competitive interest rates and fees that balance customer acquisition with revenue goals. Their data-driven strategies help optimize product pricing, directly influencing a bank's financial performance.

Analyzing Market Trends for Effective Pricing Strategies

| Role | Pricing Analyst |

|---|---|

| Primary Function | Analyzing Market Trends |

| Objective | Develop Effective Pricing Strategies in Banking |

| Key Responsibilities |

|

| Impact on Banking | Optimize profitability and market position through data-driven pricing approaches |

| Your Benefit | Access precise market insights to align pricing strategies with client demands and competitive landscape |

Collaboration Between Pricing Analysts and Other Banking Departments

Pricing analysts in banking work closely with departments such as risk management, sales, and finance to develop competitive and profitable pricing models. Effective collaboration ensures pricing strategies align with market conditions and regulatory requirements.

Collaboration between pricing analysts and risk management teams helps evaluate the potential impacts of pricing decisions on credit risk and loan portfolios. Working with sales departments provides practical insights into customer behavior and market demand, enhancing pricing accuracy. Coordination with finance ensures pricing models support the bank's profitability goals while maintaining compliance with financial reporting standards.

Regulatory Considerations in Banking Pricing Analysis

Pricing analysts in banking must navigate complex regulatory frameworks to ensure compliance with laws such as the Dodd-Frank Act and Basel III. These regulations impact how banks set interest rates, fees, and penalties across various financial products.

Regulatory considerations require analysts to incorporate risk assessment models that align with capital adequacy and consumer protection rules. Failure to comply can result in significant financial penalties and reputational damage for banking institutions.

Career Path and Advancement Opportunities for Pricing Analysts

Pricing Analysts in banking play a crucial role in determining competitive and profitable pricing strategies for financial products. Your career path offers diverse opportunities for growth through skill enhancement and increased responsibilities.

- Entry-Level Analyst - Begin by analyzing market data and customer behavior to support pricing decisions.

- Senior Pricing Analyst - Advance to leading pricing projects and refining strategies for complex banking products.

- Pricing Manager or Strategy Lead - Progress to managing teams and shaping overall pricing frameworks and policies within the bank.

Impact of Technology and Automation on Pricing Analysis in Banking

Technology and automation have transformed pricing analysis in banking by enabling faster data processing and more accurate risk assessment. These advancements allow for dynamic pricing strategies that respond in real-time to market changes.

- Advanced algorithms - Leverage machine learning to predict customer behavior and optimize pricing models efficiently.

- Automation tools - Reduce manual errors and increase the speed of pricing updates across banking products.

- Real-time data integration - Enables immediate adjustments to pricing based on market fluctuations and competitive analysis.

Your role as a Pricing Analyst now demands proficiency in technology to maintain competitive and compliant pricing strategies.

Related Important Terms

Dynamic Pricing Algorithms

Pricing analysts utilizing dynamic pricing algorithms leverage real-time data and market trends to optimize banking product fees and interest rates, maximizing profitability and customer acquisition. These algorithms analyze transaction patterns, competitor pricing, and demand fluctuations to adjust pricing strategies swiftly and competitively in a highly regulated financial environment.

Price Optimization Models

A Pricing Analyst specializing in Price Optimization Models leverages advanced statistical techniques and machine learning algorithms to analyze customer behavior, market trends, and competitive pricing in the banking sector. By developing dynamic pricing strategies, they enhance product profitability, increase market share, and improve customer acquisition and retention rates.

Real-Time Market Benchmarking

Pricing Analysts specializing in real-time market benchmarking leverage advanced data analytics and financial modeling to monitor competitive rates and adjust pricing strategies dynamically. Their expertise enables banks to optimize profit margins while maintaining market competitiveness and regulatory compliance.

Behavioral Pricing Analytics

Pricing analysts specializing in behavioral pricing analytics leverage customer data, purchasing patterns, and behavioral economics to optimize financial product pricing strategies in banking. Employing techniques such as segmentation, elasticity modeling, and predictive analytics, they enhance revenue generation while improving customer satisfaction and retention rates.

Machine Learning-Based Rate Strategy

Pricing analysts leverage machine learning algorithms to optimize interest rate strategies by analyzing historical loan performance and market trends, enhancing predictive accuracy for credit risk and customer segmentation. This data-driven approach enables banks to dynamically adjust pricing models, increasing profitability while maintaining competitive positioning in volatile financial markets.

Pricing Analyst Infographic

jobdayta.com

jobdayta.com