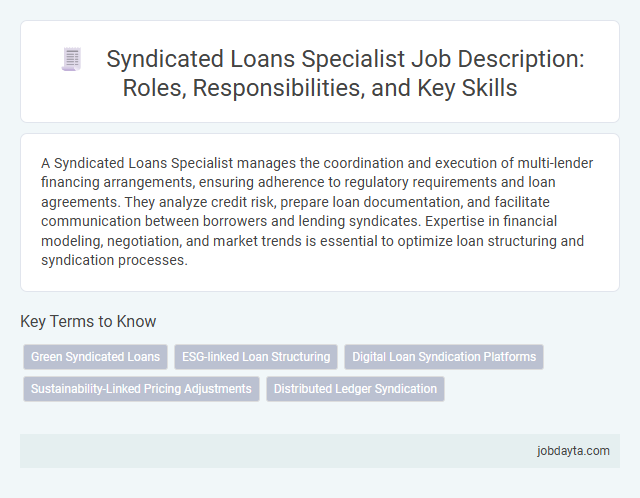

A Syndicated Loans Specialist manages the coordination and execution of multi-lender financing arrangements, ensuring adherence to regulatory requirements and loan agreements. They analyze credit risk, prepare loan documentation, and facilitate communication between borrowers and lending syndicates. Expertise in financial modeling, negotiation, and market trends is essential to optimize loan structuring and syndication processes.

Overview of a Syndicated Loans Specialist

A Syndicated Loans Specialist manages complex loan agreements involving multiple lenders to finance large-scale projects. This role requires expertise in credit analysis, risk assessment, and coordination among financial institutions.

The specialist facilitates the structuring, negotiation, and documentation of syndicated loans, ensuring compliance with regulatory standards. They monitor loan performance and communicate regularly with borrowers and participating banks. Efficient management of syndicated loans supports the lender consortium in mitigating risks while maximizing returns.

Key Roles and Responsibilities

A Syndicated Loans Specialist manages the coordination and administration of loan syndication processes among multiple financial institutions. This role requires expertise in structuring loan agreements, ensuring compliance, and facilitating communication between lenders and borrowers.

You oversee the due diligence process, monitor loan performance, and handle documentation to ensure all syndication activities align with regulatory standards. Effective relationship management with syndicate members and clients is essential to successfully closing and managing syndicated loan transactions.

Essential Skills and Qualifications

A Syndicated Loans Specialist requires in-depth knowledge of syndicated lending processes, credit analysis, and risk assessment to manage complex loan structures effectively. Proficiency in financial modeling, negotiation skills, and regulatory compliance ensures precise execution and coordination among multiple lenders. Strong communication abilities and expertise in market trends enable the specialist to optimize loan syndication and maintain client relationships.

Understanding Syndicated Loan Structures

A Syndicated Loans Specialist plays a crucial role in managing complex loan arrangements involving multiple lenders. Mastery of syndicated loan structures is essential to coordinate funding, risk, and compliance effectively.

- Loan Participation - Represents the process where multiple banks collectively fund a single borrower, distributing the credit risk among participants.

- Lead Arranger Role - The lead arranger coordinates the syndication process, structures the loan terms, and manages communication among lenders.

- Tranche Management - Syndicated loans are often divided into tranches, each with distinct interest rates and maturities tailored to meet borrower needs and lender risk profiles.

Collaboration with Financial Institutions

| Role | Syndicated Loans Specialist |

|---|---|

| Core Focus | Collaboration with Financial Institutions |

| Key Responsibilities |

|

| Collaboration Benefits |

|

| Technical Tools Used |

|

| Industry Impact |

|

Risk Assessment and Management

A Syndicated Loans Specialist plays a critical role in evaluating and managing risks associated with large loan syndications. Expertise in risk assessment ensures the stability and profitability of syndicated lending portfolios.

- Credit Risk Analysis - Involves assessing borrowers' creditworthiness to mitigate potential loan defaults.

- Market Risk Evaluation - Entails analyzing economic and interest rate fluctuations impacting loan performance.

- Compliance and Regulatory Management - Ensures all syndicated loan agreements adhere to current banking regulations and standards.

Client Relationship Management

Syndicated Loans Specialists possess in-depth knowledge of complex loan structures involving multiple lenders, ensuring efficient capital raising for large-scale projects. Expertise in coordinating among diverse financial institutions fosters seamless transaction execution and risk management.

Client Relationship Management is crucial for maintaining trust and long-term partnerships in syndicated lending. You benefit from personalized service that addresses unique financing needs and strategic goals, enhancing overall client satisfaction and loyalty.

Regulatory Compliance and Documentation

A Syndicated Loans Specialist ensures seamless coordination among multiple lenders while maintaining strict adherence to regulatory compliance. Expertise in documentation management is essential to safeguard legal integrity and mitigate financial risks throughout the loan lifecycle. Your role includes verifying that all loan agreements meet current banking regulations and industry standards.

Career Path and Advancement Opportunities

Syndicated Loans Specialists play a crucial role in managing multi-lender loan agreements within banking. This career path offers significant opportunities for professional growth and industry expertise development.

- Entry-Level Analyst - Focuses on financial analysis, loan structuring, and client due diligence within syndicated lending transactions.

- Mid-Level Associate - Manages relationships between borrowers and lenders, coordinates loan syndication processes, and supports negotiation efforts.

- Senior Syndicated Loans Specialist - Leads complex loan syndications, oversees risk assessment, and drives strategic portfolio management initiatives.

Your advancement in this field depends on expertise in credit analysis, negotiation skills, and industry networking.

Impact of Technology in Syndicated Loans Management

How is technology transforming the management of syndicated loans in banking?

Advanced software platforms streamline communication and data sharing among multiple lenders, enhancing efficiency and reducing errors. Automation tools enable real-time monitoring and reporting, improving accuracy in syndicated loan servicing and risk management.

Related Important Terms

Green Syndicated Loans

A Syndicated Loans Specialist in the banking sector coordinates multi-bank lending to finance large-scale sustainability projects, emphasizing Green Syndicated Loans that support environmentally responsible initiatives such as renewable energy and carbon reduction. Expertise in structuring these loans ensures compliance with green finance standards and optimizes risk-sharing among participating banks to promote sustainable development and achieve ESG targets.

ESG-linked Loan Structuring

A Syndicated Loans Specialist with expertise in ESG-linked loan structuring designs and manages multi-lender financing solutions that integrate environmental, social, and governance criteria into credit agreements. This role involves coordinating with multiple financial institutions to tailor loan terms that incentivize sustainable business practices and align with regulatory ESG frameworks.

Digital Loan Syndication Platforms

Syndicated Loans Specialists leverage digital loan syndication platforms to streamline the coordination among multiple lenders, enhancing deal transparency and accelerating transaction timelines. These platforms use advanced analytics, automated workflows, and real-time data sharing to optimize loan structuring, risk assessment, and investor communication in syndicated financing.

Sustainability-Linked Pricing Adjustments

Syndicated loans specialists leverage sustainability-linked pricing adjustments to incentivize borrower commitments toward environmental, social, and governance (ESG) targets, improving credit terms based on verified performance metrics. These adjustments align financial incentives with corporate sustainability goals, driving green financing trends and enhancing risk mitigation for lending institutions.

Distributed Ledger Syndication

Syndicated Loans Specialists utilizing Distributed Ledger Technology (DLT) enhance transparency and efficiency by securely recording loan agreements and transactions across multiple participants in real-time. The integration of blockchain-based syndication platforms reduces settlement times, mitigates operational risks, and streamlines communication among lenders and borrowers in complex multi-party loan arrangements.

Syndicated Loans Specialist Infographic

jobdayta.com

jobdayta.com