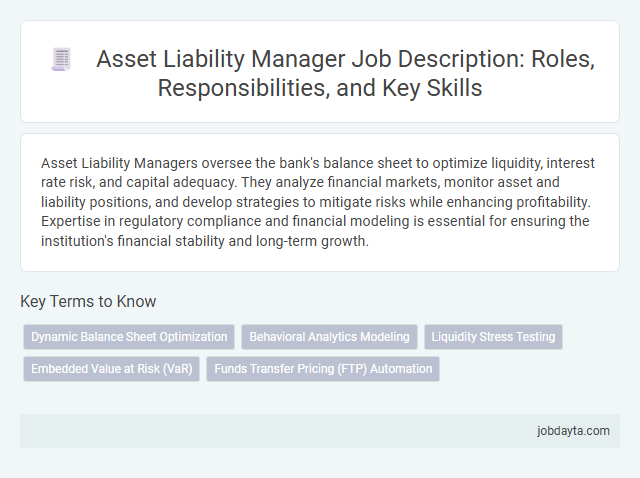

Asset Liability Managers oversee the bank's balance sheet to optimize liquidity, interest rate risk, and capital adequacy. They analyze financial markets, monitor asset and liability positions, and develop strategies to mitigate risks while enhancing profitability. Expertise in regulatory compliance and financial modeling is essential for ensuring the institution's financial stability and long-term growth.

Overview of Asset Liability Manager Role in Banking

| Role | Asset Liability Manager (ALM) |

|---|---|

| Industry | Banking and Financial Services |

| Primary Objective | Manage the bank's balance sheet by optimizing the mix of assets and liabilities to maximize profitability while minimizing risks. |

| Core Responsibilities |

|

| Key Performance Metrics |

|

| Required Skills |

|

| Impact | Ensures bank stability by balancing asset-liability mismatches, safeguarding liquidity, and improving long-term profitability. |

Key Responsibilities of an Asset Liability Manager

An Asset Liability Manager oversees the bank's balance sheet to ensure optimal liquidity, interest rate risk management, and capital adequacy. Managing interest rate gaps, forecasting cash flows, and aligning assets with liabilities are critical to maintaining financial stability. You play a vital role in strategizing investment decisions and regulatory compliance to mitigate risks effectively.

Essential Skills for Asset Liability Managers

What are the essential skills for an Asset Liability Manager in banking? An Asset Liability Manager must possess strong analytical skills to evaluate financial risks accurately. Expertise in interest rate risk management and liquidity management is crucial for maintaining balance sheet stability.

How important is communication for an Asset Liability Manager? Effective communication skills enable collaboration with different departments, ensuring alignment of risk strategies. Ability to present complex financial data clearly supports informed decision-making by senior management.

Why is regulatory knowledge vital for Asset Liability Managers? Understanding banking regulations such as Basel III and capital adequacy requirements helps in compliance and risk mitigation. Staying updated with regulatory changes avoids costly penalties and enhances strategic planning.

What role does technology proficiency play for Asset Liability Managers? Proficiency with financial modeling software and risk management tools enhances accuracy in forecasting and scenario analysis. Familiarity with data analytics strengthens insights into market trends and asset-liability mismatches.

How does problem-solving ability benefit an Asset Liability Manager? Strong problem-solving skills assist in identifying and addressing discrepancies between assets and liabilities effectively. This ability supports creating strategies that optimize profitability while minimizing financial risks.

Importance of Asset Liability Management in Banks

Asset Liability Management (ALM) is crucial for banks to maintain financial stability and optimize profitability. Effective ALM helps in managing risks related to interest rates, liquidity, and liquidity gaps.

Proper ALM ensures that your bank can meet its financial obligations without compromising on growth opportunities. It plays a key role in balancing assets and liabilities to minimize risks and enhance shareholder value.

Risk Management Techniques in Asset Liability Management

Asset Liability Managers play a crucial role in balancing risks and returns by managing the bank's financial assets and liabilities. Risk management techniques in Asset Liability Management (ALM) aim to protect the institution from interest rate fluctuations, liquidity shortages, and market volatility.

Effective ALM risk management involves gap analysis, duration analysis, and simulation modeling to forecast potential impacts on net interest income and economic value. Stress testing and scenario analysis are essential tools to identify vulnerabilities under adverse market conditions. Your financial stability depends on implementing these sophisticated techniques to mitigate risks and optimize asset-liability alignment.

Tools and Software Used by Asset Liability Managers

Asset Liability Managers utilize specialized tools and software to optimize risk management and financial stability. These technologies enable precise modeling of interest rate risks, liquidity gaps, and capital adequacy.

- ALM Software Platforms - These integrated platforms provide simulations and reports for managing interest rate risk and liquidity mismatches.

- Risk Analytics Tools - Advanced analytics software analyzes market data to predict potential impacts on asset and liability portfolios.

- Regulatory Compliance Systems - Compliance software ensures adherence to banking regulations related to capital requirements and reporting standards.

Collaboration Between Asset Liability Managers and Other Departments

Asset Liability Managers (ALMs) work closely with multiple departments to optimize financial stability and risk management. Effective collaboration ensures alignment of asset and liability strategies with overall bank objectives.

- Coordination with Treasury - ALMs partner with the Treasury team to manage liquidity risk and funding strategies efficiently.

- Collaboration with Risk Management - ALMs and Risk Management jointly analyze interest rate risk and credit exposures to maintain balanced portfolios.

- Communication with Finance and Accounting - ALMs provide vital data to Finance for accurate financial reporting and regulatory compliance.

Challenges Faced by Asset Liability Managers

Asset Liability Managers (ALMs) play a critical role in balancing the risks and returns associated with a bank's assets and liabilities. Their work involves navigating complex financial environments to maintain liquidity and profitability.

- Interest Rate Risk Management - ALMs must continuously monitor and manage the impact of fluctuating interest rates on the bank's net interest margin.

- Liquidity Risk - Ensuring sufficient liquidity to meet short-term obligations without compromising long-term investments remains a persistent challenge.

- Regulatory Compliance - ALMs face the ongoing task of aligning asset and liability strategies with evolving banking regulations and capital requirements.

Effective asset liability management is essential for financial stability and optimizing a bank's risk-return profile.

Career Path and Qualifications for Asset Liability Managers

An Asset Liability Manager oversees a bank's financial risks by managing the balance between assets and liabilities to ensure liquidity and profitability. Career paths often begin with roles in treasury, risk management, or financial analysis, progressing to specialized asset liability management positions. Qualifications typically include a degree in finance, economics, or business, along with certifications like CFA or FRM to demonstrate expertise in risk assessment and financial strategy.

Future Trends in Asset Liability Management in Banking

Future trends in Asset Liability Management (ALM) in banking emphasize enhanced data analytics and real-time risk assessment. Advanced AI and machine learning models enable banks to forecast interest rate fluctuations and liquidity risks with greater precision.

Blockchain technology is increasingly integrated to improve transparency and security in asset-liability matching processes. Your bank can leverage these innovations to optimize capital allocation and regulatory compliance in a dynamic market environment.

Related Important Terms

Dynamic Balance Sheet Optimization

An Asset Liability Manager specializes in dynamic balance sheet optimization by continuously analyzing interest rate risks, liquidity positions, and capital adequacy to maximize profitability while ensuring regulatory compliance. Advanced modeling techniques and real-time data integration allow for strategic adjustments that enhance risk-return profiles across diverse financial instruments.

Behavioral Analytics Modeling

Behavioral Analytics Modeling in Asset Liability Management leverages advanced data analysis to predict customer behaviors affecting liquidity and interest rate risks, enabling banks to optimize balance sheet strategies. Utilizing transaction histories, repayment patterns, and market trends, this modeling enhances risk forecasting and regulatory compliance for improved financial stability.

Liquidity Stress Testing

Liquidity stress testing is a critical function performed by the Asset Liability Manager to evaluate a bank's ability to withstand severe cash flow disruptions under adverse market conditions. By simulating extreme but plausible scenarios, the manager ensures adequate liquidity buffers are maintained to meet short-term obligations and regulatory requirements.

Embedded Value at Risk (VaR)

Asset Liability Managers utilize Embedded Value at Risk (VaR) to quantify potential losses within a bank's asset and liability portfolio under various market conditions, enhancing risk-adjusted decision-making. This metric integrates market, credit, and operational risks to optimize capital allocation and ensure regulatory compliance.

Funds Transfer Pricing (FTP) Automation

Funds Transfer Pricing (FTP) automation enhances an Asset Liability Manager's ability to accurately allocate costs and revenues across business units, improving risk-adjusted performance measurement and profitability analysis. Implementing advanced FTP automation streamlines data integration and real-time processing, enabling more precise liquidity management and regulatory compliance in banking operations.

Asset Liability Manager Infographic

jobdayta.com

jobdayta.com