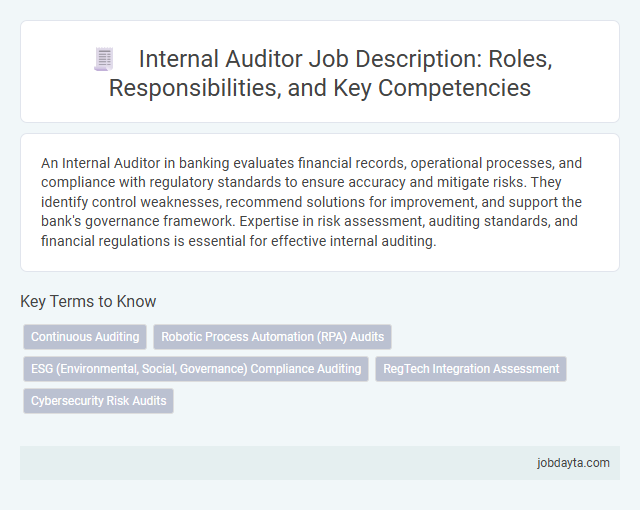

An Internal Auditor in banking evaluates financial records, operational processes, and compliance with regulatory standards to ensure accuracy and mitigate risks. They identify control weaknesses, recommend solutions for improvement, and support the bank's governance framework. Expertise in risk assessment, auditing standards, and financial regulations is essential for effective internal auditing.

Overview of Internal Auditor Role in Banking

The Internal Auditor in banking plays a critical role in assessing the effectiveness of risk management, internal controls, and governance processes. This role ensures compliance with regulatory requirements and helps safeguard the bank's assets.

Internal Auditors analyze financial records, operational procedures, and information systems to identify vulnerabilities and recommend improvements. Their work supports transparency and accountability, enhancing the bank's overall stability and customer trust.

Key Responsibilities of an Internal Auditor

An Internal Auditor in banking evaluates the effectiveness of internal controls, risk management, and compliance with regulatory standards. You ensure that financial records are accurate and identify any operational inefficiencies or fraudulent activities. Your role is crucial in providing assurance to stakeholders about the integrity of the bank's financial and operational processes.

Essential Skills and Competencies for Internal Auditors

Internal auditors in banking must possess strong analytical skills to assess financial records and ensure regulatory compliance. Expertise in risk management and internal controls is essential for identifying vulnerabilities and mitigating potential threats. Effective communication abilities enable internal auditors to report findings clearly to stakeholders and recommend actionable improvements.

Importance of Internal Auditing in Banking Sector

Why is internal auditing crucial in the banking sector? Internal auditing ensures compliance with regulatory standards, reducing the risk of financial fraud. It enhances the reliability of financial reporting and protects the bank's assets.

Daily Tasks and Duties of a Banking Internal Auditor

An Internal Auditor in banking plays a crucial role in maintaining financial integrity and compliance. Their daily tasks ensure the bank's operations align with regulatory standards and internal policies.

- Risk Assessment - You evaluate the bank's processes to identify potential financial and operational risks.

- Compliance Monitoring - You verify adherence to banking laws, internal policies, and regulatory requirements.

- Audit Reporting - You prepare detailed reports highlighting findings, discrepancies, and recommendations for improvement.

Consistent execution of these duties safeguards the bank's assets and supports transparent financial management.

Compliance and Risk Management Responsibilities

Internal Auditors in banking play a crucial role in ensuring compliance with regulatory standards and internal policies. Their work supports the bank's integrity and safeguards against operational risks.

An Internal Auditor evaluates the effectiveness of risk management frameworks and verifies adherence to legal and regulatory requirements. They identify potential compliance gaps and recommend corrective actions to mitigate risks. Your role involves continuous monitoring to ensure that all banking processes align with industry regulations and organizational guidelines.

Tools and Techniques Used by Internal Auditors

Internal auditors in banking rely on specialized tools and techniques to ensure thorough risk assessment and compliance monitoring. These resources enhance the accuracy and efficiency of audit processes to protect financial integrity.

- Data Analytics Software - Enables auditors to analyze large datasets for identifying anomalies and trends relevant to banking transactions and controls.

- Automated Audit Management Systems - Streamlines audit planning, execution, and reporting, improving workflow and documentation consistency.

- Risk Assessment Frameworks - Provides structured methodologies to evaluate financial, operational, and compliance risks within banking institutions.

Qualifications and Certifications Required

Internal auditors in banking require a strong foundation in finance, accounting, and risk management to assess internal controls effectively. A bachelor's degree in accounting, finance, or a related field is typically essential for entry into this role.

Certifications such as Certified Internal Auditor (CIA) and Certified Public Accountant (CPA) enhance credibility and expertise in auditing standards. Additional certifications like Certified Information Systems Auditor (CISA) can be valuable for addressing IT audit requirements within banking institutions.

Career Path and Growth Opportunities

| Position | Internal Auditor |

|---|---|

| Industry | Banking Sector |

| Career Path Overview | Starting as a Junior Internal Auditor, progressing to Internal Auditor, Senior Internal Auditor, Audit Manager, and eventually Chief Audit Executive or Head of Internal Audit. |

| Key Skills Required | Risk assessment, compliance knowledge, financial analysis, regulatory understanding, and strong communication skills. |

| Growth Opportunities | Specialization in IT audit, regulatory compliance, fraud investigation, or moving into broader risk management and finance leadership roles. |

| Certifications That Enhance Career Growth | Certified Internal Auditor (CIA), Certified Information Systems Auditor (CISA), Chartered Accountant (CA), and Certified Fraud Examiner (CFE). |

| Impact of Role | Ensures banking operations comply with regulatory standards, strengthens internal controls, and reduces financial and operational risks. |

| Your Career Advantage | Developing expertise as an Internal Auditor provides a strong foundation for leadership roles in banking compliance, risk management, and operational strategy. |

Challenges Faced by Internal Auditors in Banking

Internal auditors in banking face complex challenges that impact their ability to ensure compliance and mitigate risks effectively. These challenges require auditors to continuously adapt to evolving regulatory environments and technological advancements.

- Regulatory Compliance Complexity - Navigating constantly changing financial regulations demands thorough understanding and timely updates to auditing processes.

- Data Security Risks - Ensuring the protection of sensitive customer information amid rising cyber threats is a critical concern for auditors.

- Technological Integration - Adapting auditing techniques to new banking technologies like blockchain and AI requires ongoing skill development.

Related Important Terms

Continuous Auditing

Continuous auditing in banking leverages real-time data analysis and automated tools to promptly identify compliance issues, operational risks, and fraud, enhancing internal audit effectiveness and regulatory adherence. Internal auditors utilize continuous auditing techniques to provide ongoing assurance, improve risk management processes, and support timely decision-making within financial institutions.

Robotic Process Automation (RPA) Audits

Internal Auditors specializing in Robotic Process Automation (RPA) audits evaluate automated workflows to ensure compliance with regulatory standards and identify operational risks. They leverage advanced analytics and continuous monitoring tools to enhance audit accuracy, streamline control testing, and detect anomalies in bot performance within banking processes.

ESG (Environmental, Social, Governance) Compliance Auditing

Internal auditors specializing in ESG compliance auditing rigorously evaluate banking institutions' adherence to environmental regulations, social responsibility standards, and governance frameworks, ensuring risk management and sustainable practices align with regulatory requirements. Leveraging frameworks such as SASB and GRI, these auditors identify gaps in ESG reporting accuracy, internal controls, and policy implementation to enhance transparency and stakeholder trust.

RegTech Integration Assessment

Internal auditors in banking play a critical role in RegTech integration assessment by evaluating the effectiveness of regulatory technology tools in enhancing compliance monitoring and risk management processes. Their assessments ensure that RegTech solutions align with regulatory requirements, optimize operational efficiency, and mitigate potential compliance risks within financial institutions.

Cybersecurity Risk Audits

Internal auditors specializing in cybersecurity risk audits assess the effectiveness of a bank's information security controls, identifying vulnerabilities within firewalls, encryption protocols, and intrusion detection systems. They evaluate compliance with regulatory frameworks such as PCI DSS, GDPR, and FFIEC guidelines to mitigate risks of data breaches and ensure the integrity of financial transactions.

Internal Auditor Infographic

jobdayta.com

jobdayta.com