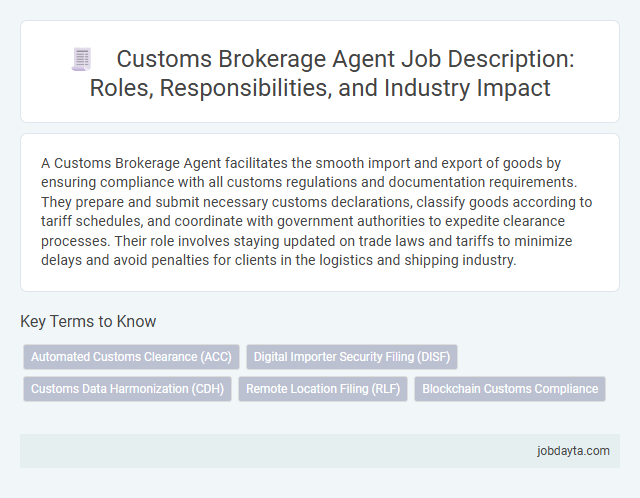

A Customs Brokerage Agent facilitates the smooth import and export of goods by ensuring compliance with all customs regulations and documentation requirements. They prepare and submit necessary customs declarations, classify goods according to tariff schedules, and coordinate with government authorities to expedite clearance processes. Their role involves staying updated on trade laws and tariffs to minimize delays and avoid penalties for clients in the logistics and shipping industry.

Overview of Customs Brokerage Agent Role in Logistics

Customs brokerage agents play a crucial role in the seamless movement of goods across international borders. Their expertise ensures compliance with complex customs regulations, minimizing delays in logistics operations.

- Regulatory Compliance - Customs brokers navigate diverse import and export laws to ensure shipments meet all legal requirements.

- Documentation Management - They prepare and submit necessary customs documentation accurately to prevent clearance issues.

- Cost Optimization - Brokers advise on tariffs, duties, and tax implications to reduce overall shipment expenses.

Your logistics process benefits significantly from skilled customs brokerage agents by accelerating clearance and safeguarding compliance.

Key Responsibilities of a Customs Brokerage Agent

A Customs Brokerage Agent ensures all imported and exported goods comply with international customs regulations. They prepare and submit necessary documentation for customs clearance, minimizing delays and avoiding penalties. You rely on their expertise to navigate tariffs, duties, and complex legal requirements efficiently.

Essential Skills and Qualifications for Customs Brokers

Customs brokerage agents must possess a deep understanding of international trade regulations, tariff classifications, and import-export compliance. Strong analytical skills and attention to detail are essential to accurately process documentation and ensure adherence to customs laws. Your ability to communicate effectively with government agencies and clients enhances the efficiency of customs clearance and reduces shipment delays.

Importance of Customs Brokerage in Global Trade

Customs brokerage agents play a critical role in ensuring the smooth flow of goods across international borders. They handle complex documentation and compliance requirements to prevent costly delays and penalties.

Efficient customs brokerage helps maximize supply chain efficiency and reduces the risk of shipment holds and inspections. Your business benefits from faster clearance times and enhanced regulatory adherence, supporting global trade success.

Daily Tasks and Workflow of a Customs Brokerage Agent

A Customs Brokerage Agent plays a crucial role in facilitating the smooth import and export of goods by ensuring compliance with all customs regulations. Your daily tasks involve coordinating documentation, managing shipments, and liaising with customs authorities to prevent delays.

- Reviewing Import and Export Documentation - Verify accuracy and completeness of commercial invoices, bills of lading, and packing lists to meet regulatory requirements.

- Calculating Duties and Taxes - Determine applicable tariffs and fees based on product classifications and country-specific trade agreements.

- Communicating with Customs Authorities - Submit declarations and respond to inquiries or audits to expedite clearance processes.

Regulatory Compliance and Documentation Management

Efficient customs brokerage agents ensure seamless regulatory compliance and accurate documentation management. Your shipments move smoothly across borders by adhering to complex import-export laws and maintaining precise records.

- Regulatory Compliance - Experts monitor and interpret international trade laws to prevent delays and penalties.

- Documentation Accuracy - Complete and correct paperwork is prepared to meet customs requirements and avoid inspection issues.

- Risk Mitigation - Proactive management of customs regulations reduces the risk of fines and shipment holds.

Challenges Faced by Customs Brokerage Agents

Customs brokerage agents navigate complex regulatory environments to ensure goods clear customs efficiently. They must stay updated on constantly changing trade laws and compliance requirements.

Delays caused by incomplete documentation or misclassification of goods can result in costly penalties and shipment hold-ups. Agents face pressure to balance speed with accuracy while managing diverse client needs. Technological advancements require continuous learning to optimize clearance processes and maintain competitive advantage.

Impact of Customs Brokerage on Supply Chain Efficiency

How does a Customs Brokerage Agent influence supply chain efficiency? Customs Brokerage Agents streamline the import and export process by ensuring compliance with all regulatory requirements, reducing delays at borders. This expertise minimizes the risk of costly fines and accelerates cargo clearance, directly enhancing your supply chain performance.

Technological Tools Used by Customs Brokers

Customs brokerage agents utilize advanced technological tools to streamline the clearance process, ensuring quicker and more accurate customs submissions. Software such as Automated Commercial Environment (ACE) and Electronic Data Interchange (EDI) systems facilitate seamless communication between brokers and customs authorities.

These tools help in real-time tracking of shipments, reducing errors and enhancing compliance with international trade regulations. Implementing AI-driven analytics enables brokers to predict potential delays and optimize supply chain efficiency effectively.

Career Growth and Opportunities in Customs Brokerage Industry

| Aspect | Details |

|---|---|

| Career Growth | Customs brokerage offers significant career advancement through skill enhancement and industry certifications. Professionals can progress from entry-level agents to senior brokers, compliance specialists, or customs consultants. |

| Industry Demand | Global trade expansion fuels increasing demand for skilled customs brokerage agents. Expertise in import/export regulations, tariff classifications, and trade compliance commands competitive salaries and job security. |

| Skill Development | Developing knowledge in customs laws, international trade agreements, and logistics management enables career progression. Continuous learning through training programs and certifications, such as Certified Customs Specialist (CCS), enhances professional value. |

| Opportunities | Roles in customs brokerage span public agencies, private firms, and multinational corporations. Career paths include customs inspection, documentation management, and international trade consulting. Networking with industry professionals opens doors to specialized positions. |

| Technology Integration | Adoption of customs clearance software and automated compliance tools increases efficiency. Mastery of these technologies positions you as a valuable asset in the industry, driving both career growth and operational excellence. |

Related Important Terms

Automated Customs Clearance (ACC)

Automated Customs Clearance (ACC) revolutionizes the role of customs brokerage agents by streamlining the submission and processing of import and export documents through digital platforms, reducing clearance times and minimizing human errors. ACC systems integrate with government databases to ensure compliance with trade regulations, enhance data accuracy, and provide real-time status updates, optimizing supply chain efficiency and reducing operational costs for logistics companies.

Digital Importer Security Filing (DISF)

Customs brokerage agents play a critical role in managing Digital Importer Security Filing (DISF) to ensure compliance with U.S. Customs and Border Protection regulations, streamlining the import process by electronically submitting advance cargo information. Proper DISF filing enhances cargo security and facilitates timely clearance, reducing delays and penalties associated with non-compliance in international logistics operations.

Customs Data Harmonization (CDH)

Customs Brokerage Agents leverage Customs Data Harmonization (CDH) to streamline import and export processes by standardizing tariff codes, product classifications, and compliance documentation across international borders. This harmonization enhances shipment accuracy, reduces clearance delays, and ensures adherence to global trade regulations.

Remote Location Filing (RLF)

Customs brokerage agents streamline shipments by utilizing Remote Location Filing (RLF) to electronically submit import and export declarations directly to customs authorities from any location. This process enhances efficiency, reduces delays at ports, and ensures compliance with customs regulations through real-time data transmission.

Blockchain Customs Compliance

Blockchain technology enhances customs brokerage by providing a secure, transparent ledger for verifying and recording cross-border transactions, accelerating customs clearance and reducing fraud. Customs brokerage agents leverage blockchain to ensure regulatory compliance, streamline documentation, and enable real-time tracking of shipments through decentralized networks.

Customs Brokerage Agent Infographic

jobdayta.com

jobdayta.com