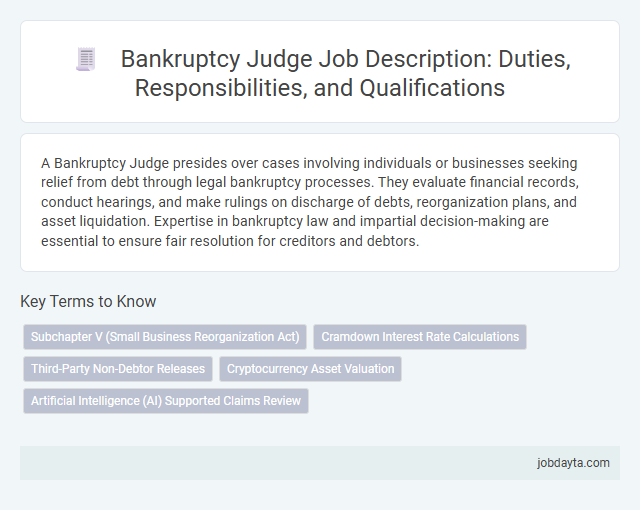

A Bankruptcy Judge presides over cases involving individuals or businesses seeking relief from debt through legal bankruptcy processes. They evaluate financial records, conduct hearings, and make rulings on discharge of debts, reorganization plans, and asset liquidation. Expertise in bankruptcy law and impartial decision-making are essential to ensure fair resolution for creditors and debtors.

Overview of Bankruptcy Judge Role

A Bankruptcy Judge specializes in adjudicating cases involving debt relief under bankruptcy laws. They oversee proceedings to ensure fair treatment of creditors and debtors while enforcing legal standards. Their role includes ruling on disputes, approving repayment plans, and managing asset distribution during bankruptcy cases.

Key Duties and Responsibilities of a Bankruptcy Judge

A Bankruptcy Judge oversees legal proceedings involving individuals or businesses unable to repay debts, ensuring fair and lawful resolution of bankruptcy cases. They interpret and apply bankruptcy laws, rule on motions, confirm reorganization plans, and facilitate creditor-debtor negotiations. Their responsibilities also include issuing orders, managing case administration, and protecting the rights of all parties involved in bankruptcy litigation.

Essential Qualifications and Educational Requirements

A Bankruptcy Judge plays a critical role in overseeing cases involving insolvency and debt resolution. Your expertise ensures fair and lawful administration of bankruptcy proceedings.

- Legal Education - A Juris Doctor (JD) degree from an accredited law school is required to become a Bankruptcy Judge.

- Judicial Experience - Significant prior experience as a practicing attorney or judge in bankruptcy law is essential.

- Federal Appointment - Bankruptcy Judges are appointed by the U.S. Court of Appeals and serve renewable terms of 14 years.

Strong knowledge of bankruptcy statutes and excellent analytical skills are crucial for this position.

Legal Knowledge and Expertise Needed

What legal knowledge is essential for a Bankruptcy Judge to effectively oversee cases? A Bankruptcy Judge must have a deep understanding of bankruptcy laws, including chapters 7, 11, and 13 of the U.S. Bankruptcy Code. Expertise in both federal and state regulations related to debt repayment and asset liquidation is crucial.

How does a Bankruptcy Judge apply their legal expertise during complex financial cases? They interpret and enforce laws to ensure fair treatment of creditors and debtors while maintaining the integrity of the bankruptcy process. Your case depends on their ability to analyze intricate financial details and legal precedents.

Day-to-Day Activities and Case Management

A Bankruptcy Judge oversees complex insolvency cases, ensuring fair and efficient resolution of financial disputes. Their role involves interpreting bankruptcy laws to guide debt restructuring and asset liquidation processes.

Day-to-day activities include reviewing case filings, presiding over hearings, and issuing rulings that impact multiple stakeholders. Your interactions with a Bankruptcy Judge often shape the trajectory of bankruptcy proceedings and case outcomes.

Decision-Making and Judicial Discretion in Bankruptcy Cases

Bankruptcy judges play a crucial role in the administration of bankruptcy cases, exercising significant judicial discretion to ensure fair and equitable outcomes. Their decision-making process involves interpreting complex laws while balancing the interests of debtors, creditors, and other stakeholders.

In bankruptcy cases, judges evaluate the validity of claims, approve reorganization plans, and resolve disputes based on legal precedent and the specifics of each case. Their discretionary power allows them to adapt rulings to unique circumstances, ensuring that justice is served effectively. Understanding the decision-making authority of a bankruptcy judge can help you navigate the legal process with greater confidence.

Ethical Standards and Professional Conduct

Bankruptcy judges must uphold the highest ethical standards to maintain public trust in the judicial system. Their professional conduct is governed by strict rules ensuring impartiality, integrity, and fairness in all proceedings.

- Impartiality - Bankruptcy judges are required to avoid any conflicts of interest and maintain neutrality to preserve unbiased decision-making.

- Integrity - Judges must demonstrate honesty and adhere to legal and ethical codes to foster confidence in bankruptcy rulings.

- Confidentiality - Maintaining the privacy of sensitive financial and personal information is critical in bankruptcy cases to protect all parties involved.

Skills and Competencies for Bankruptcy Judges

Bankruptcy Judges must demonstrate strong analytical skills to interpret complex financial documents and legal statutes accurately. Mastery in legal reasoning enables effective decision-making in intricate bankruptcy cases.

Exceptional communication skills are essential for clearly explaining rulings and managing courtroom proceedings. Your ability to maintain impartiality and exercise sound judgment is critical for upholding judicial integrity.

Career Path and Appointment Process

Bankruptcy judges specialize in insolvency law and oversee cases involving debtor-creditor relationships. Their career path combines extensive legal experience with a rigorous appointment process.

- Legal Background - Candidates typically possess years of experience as practicing attorneys or magistrate judges specializing in bankruptcy or commercial law.

- Nomination Process - Bankruptcy judges are appointed by the U.S. Court of Appeals for their circuit through a merit-based selection committee.

- Term and Confirmation - They serve renewable 14-year terms after appointment without requiring Senate confirmation.

Challenges and Opportunities in Bankruptcy Judiciary

| Aspect | Challenges | Opportunities |

|---|---|---|

| Case Complexity | Increasing complexity of financial instruments complicates case evaluation and decision-making for bankruptcy judges. Cross-border insolvencies require deeper understanding of international bankruptcy laws and coordination. | Specialized training in complex financial structures enhances judge expertise. Collaboration with international courts improves cross-jurisdictional resolution efficiency. |

| Volume of Filings | Surge in bankruptcy filings can overwhelm judicial resources, leading to case backlogs and delayed rulings. Resource constraints limit thorough case analysis. | Implementation of advanced case management systems optimizes workflow and reduces delays. Delegation practices allow better distribution of tasks among magistrates and clerks. |

| Legal Framework Evolution | Rapid legislative changes and varying state laws create uncertainty and inconsistencies in rulings. Judges face challenges adapting to new statutes and precedent. | Continuous legal education programs help judges stay updated. Integration of standardized national guidelines promotes uniformity in adjudication. |

| Technological Integration | Adoption barriers of digital tools impact judicial efficiency. Cybersecurity concerns affect confidentiality and data integrity in bankruptcy proceedings. | Utilization of e-filing systems and virtual hearings streamlines case processing. Enhanced data security protocols safeguard sensitive information. |

| Stakeholder Interaction | Balancing interests of debtors, creditors, and trustees requires impartiality and comprehensive understanding of competing claims. Potential conflicts prolong adjudication. | Promoting mediation and alternative dispute resolution within bankruptcy cases encourages amicable settlements. Strong judicial leadership fosters trust and transparency. |

| Economic Environment | Economic downturns increase bankruptcy rates, pressuring judges to handle broader caseloads amid financial uncertainty. Market volatility affects asset valuation in proceedings. | Judges leverage economic indicators to inform decisions responsibly. Partnerships with financial experts support accurate assessment of debtor viability. |

Related Important Terms

Subchapter V (Small Business Reorganization Act)

Bankruptcy judges overseeing Subchapter V cases under the Small Business Reorganization Act apply streamlined procedures to facilitate quick, cost-effective restructuring for small businesses with debts less than $7.5 million. These judges prioritize debtor rehabilitation by encouraging negotiated plans that preserve business operations and maximize creditor returns within a simplified framework.

Cramdown Interest Rate Calculations

Bankruptcy judges apply cramdown interest rate calculations to ensure the reorganization plan's feasibility, typically setting rates based on the prime rate plus a risk adjustment reflecting the debtor's creditworthiness. This calculation balances creditor recovery with debtor affordability, adhering to the Supreme Court's rulings in Till v. SCS Credit Corp and subsequent case law developments.

Third-Party Non-Debtor Releases

Bankruptcy judges critically evaluate third-party non-debtor releases to determine their fairness and necessity within a reorganization plan, balancing creditor interests against the need to facilitate debtor restructuring. Such releases are scrutinized under standards like "good cause" or "fair consideration" to prevent unjustified immunity from liability for non-debtors involved in the bankruptcy case.

Cryptocurrency Asset Valuation

Bankruptcy judges assessing cryptocurrency asset valuation rely heavily on blockchain analytics and expert testimony to determine fair market value amid volatile market conditions. Accurate valuation is critical for equitable distribution of assets and mitigating risks of fraud or undervaluation during insolvency proceedings.

Artificial Intelligence (AI) Supported Claims Review

Bankruptcy judges increasingly rely on Artificial Intelligence (AI)-supported claims review to expedite case processing, enhance accuracy in claim verification, and reduce administrative burdens. AI algorithms analyze vast volumes of financial data and legal documents, enabling efficient identification of valid claims and detection of fraudulent submissions in complex bankruptcy proceedings.

Bankruptcy Judge Infographic

jobdayta.com

jobdayta.com