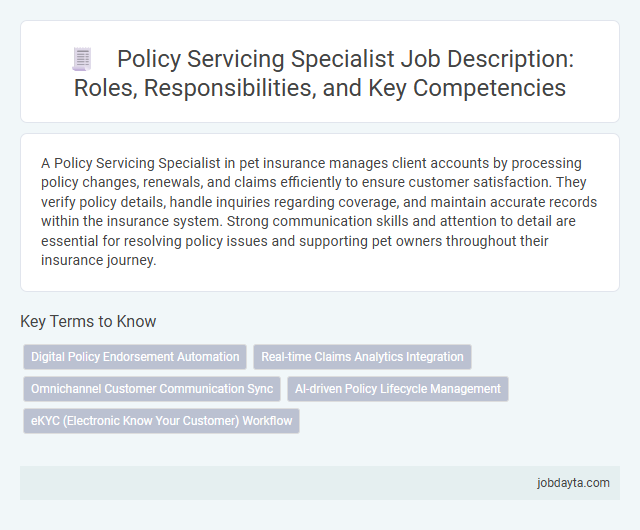

A Policy Servicing Specialist in pet insurance manages client accounts by processing policy changes, renewals, and claims efficiently to ensure customer satisfaction. They verify policy details, handle inquiries regarding coverage, and maintain accurate records within the insurance system. Strong communication skills and attention to detail are essential for resolving policy issues and supporting pet owners throughout their insurance journey.

Overview of a Policy Servicing Specialist Role in Insurance

| Role | Policy Servicing Specialist |

|---|---|

| Industry | Insurance |

| Primary Responsibilities | Managing client insurance policies, processing policy changes, handling renewals, and maintaining accurate policy records. Acting as a liaison between clients and underwriters to resolve policy issues efficiently. |

| Key Skills | Strong knowledge of insurance products, attention to detail, communication skills, customer service expertise, and proficiency with policy management software. |

| Typical Tasks | Updating client information, processing endorsements, billing coordination, responding to customer inquiries regarding policy coverage and claims, and ensuring compliance with insurance regulations. |

| Impact on Business | Enhances customer satisfaction through timely and accurate service, reduces policy errors, and contributes to client retention and operational efficiency in insurance companies. |

| Required Qualifications | Background in insurance or related fields, familiarity with regulatory requirements, and relevant certifications like CPCU or CIC are advantageous. |

Key Responsibilities of a Policy Servicing Specialist

A Policy Servicing Specialist manages client insurance policies to ensure accuracy and compliance with company standards. This role requires detailed knowledge of insurance products and exceptional customer service skills.

- Policy Management - Oversees policy updates, renewals, and amendments to maintain accurate records and client satisfaction.

- Customer Support - Provides timely assistance and resolution for client inquiries related to policy coverage and claims.

- Compliance Monitoring - Ensures all policy servicing activities adhere to regulatory requirements and internal guidelines.

Effective policy servicing enhances client retention and supports the company's operational efficiency in the insurance sector.

Essential Skills and Competencies for Policy Servicing Specialists

Policy Servicing Specialists play a critical role in managing insurance policies efficiently and ensuring customer satisfaction. Mastery of specific skills and competencies enhances their ability to handle policy administration and client interactions effectively.

- Attention to Detail - Ensures accurate processing of policy information and minimizes errors in documentation.

- Customer Communication Skills - Facilitates clear and empathetic interactions with policyholders to resolve queries and provide support.

- Regulatory Knowledge - Maintains compliance with insurance laws and company policies to manage risk and uphold standards.

Daily Tasks and Workflow in Policy Servicing

Policy Servicing Specialists manage daily interactions related to insurance policies, ensuring accurate processing of endorsements, renewals, and cancellations. They serve as primary contacts for policyholders, addressing inquiries and resolving issues promptly to maintain customer satisfaction.

These specialists review policy documentation for accuracy and compliance with regulatory standards. They coordinate with underwriters, claims adjusters, and billing departments to streamline workflow and maintain up-to-date policy records.

Customer Interaction and Support Duties

Policy Servicing Specialists play a critical role in managing customer accounts and ensuring accurate policy administration. They address inquiries, process policy changes, and resolve issues to maintain client satisfaction and compliance with insurance regulations. Your interaction with these specialists guarantees seamless support and timely updates throughout the lifecycle of your insurance policy.

Handling Policy Updates and Amendments

A Policy Servicing Specialist ensures accurate handling of policy updates and amendments to maintain up-to-date coverage details. This role involves verifying client information, processing changes in coverage, and coordinating with various departments for seamless policy adjustments. You can rely on their expertise to keep your insurance policies current and compliant with industry standards.

Importance of Accuracy and Attention to Detail

Policy Servicing Specialists play a critical role in managing insurance policies accurately and efficiently. Their attention to detail ensures that all client information and coverage details are correctly maintained.

Accuracy in policy servicing prevents costly errors and claim disputes, enhancing customer satisfaction and trust. Specialists meticulously review policy documents, update records, and handle endorsements with precision. This focus on detail supports regulatory compliance and reduces operational risks within the insurance company.

Collaboration with Underwriting and Claims Teams

A Policy Servicing Specialist plays a crucial role in ensuring seamless communication between underwriting and claims teams. Their expertise facilitates accurate policy adjustments and efficient claims processing.

Collaboration with underwriting ensures that policies reflect the most current risk assessments and coverage terms. Close coordination with the claims team accelerates claim resolutions and enhances customer satisfaction.

Career Path and Growth Opportunities in Policy Servicing

Policy Servicing Specialists play a crucial role in managing insurance policies and ensuring customer satisfaction. Your career in this field offers a clear path with numerous growth opportunities.

- Entry-Level Roles - Start as a Policy Servicing Representative handling policy updates and customer inquiries.

- Advanced Positions - Progress to Senior Policy Servicing Specialist focusing on complex case resolution and team coordination.

- Leadership Opportunities - Transition into management roles such as Policy Servicing Manager, overseeing operations and strategy implementation.

Tools and Software Commonly Used by Policy Servicing Specialists

What tools and software are essential for a Policy Servicing Specialist? Policy Servicing Specialists rely on advanced customer relationship management (CRM) systems like Salesforce and Guidewire PolicyCenter to manage client policies efficiently. These platforms streamline communication, policy updates, and claims processing to enhance service quality.

How do policy management systems improve your workflow as a Policy Servicing Specialist? Policy management software such as Duck Creek and Majesco automates policy issuance, endorsements, and renewals, reducing manual errors. This automation enables faster response times and more accurate policy servicing for clients.

Which data analytics tools support decision-making in policy servicing? Tools like Microsoft Power BI and Tableau help Policy Servicing Specialists analyze client data and identify trends that influence underwriting and customer retention strategies. Leveraging these insights ensures personalized service and risk management.

What role do communication platforms play in policy servicing? Email management software, live chat tools, and integrated telephony systems enable Policy Servicing Specialists to maintain timely and clear communication with policyholders. Effective communication tools are crucial for resolving inquiries and processing policy changes swiftly.

Related Important Terms

Digital Policy Endorsement Automation

Policy Servicing Specialists enhance efficiency by utilizing digital policy endorsement automation to streamline updates and modifications in insurance contracts, reducing processing time and minimizing errors. Leveraging advanced software tools, they facilitate instant policy adjustments, improving customer satisfaction and operational accuracy in insurance service delivery.

Real-time Claims Analytics Integration

Policy Servicing Specialists leverage real-time claims analytics integration to enhance claim processing accuracy and expedite customer response times. This integration enables proactive decision-making by continuously monitoring claim data, improving fraud detection, and optimizing resource allocation for superior policyholder support.

Omnichannel Customer Communication Sync

A Policy Servicing Specialist ensures seamless omnichannel customer communication synchronization, integrating phone, email, chat, and social media interactions to deliver consistent policy information and updates. Leveraging CRM systems and AI-driven tools enhances real-time data accuracy, improving customer satisfaction and operational efficiency in insurance policy management.

AI-driven Policy Lifecycle Management

A Policy Servicing Specialist leverages AI-driven policy lifecycle management to enhance accuracy, reduce processing time, and improve customer satisfaction by automating claims, renewals, and endorsements. Advanced machine learning algorithms analyze policy data, enabling predictive insights and proactive service tailored to individual client needs.

eKYC (Electronic Know Your Customer) Workflow

Policy Servicing Specialists streamline customer verification through eKYC workflows, ensuring compliance with regulatory standards and reducing onboarding time by automating identity checks using biometric and digital document validation. Enhanced eKYC processes improve data accuracy, minimize fraud risks, and provide seamless policy updates for insurance clients.

Policy Servicing Specialist Infographic

jobdayta.com

jobdayta.com