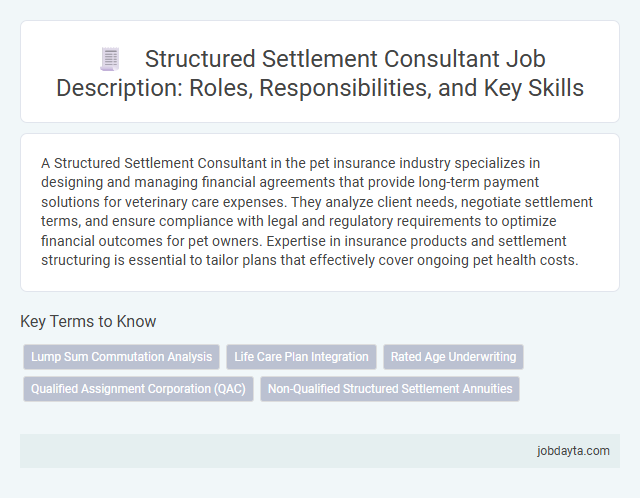

A Structured Settlement Consultant in the pet insurance industry specializes in designing and managing financial agreements that provide long-term payment solutions for veterinary care expenses. They analyze client needs, negotiate settlement terms, and ensure compliance with legal and regulatory requirements to optimize financial outcomes for pet owners. Expertise in insurance products and settlement structuring is essential to tailor plans that effectively cover ongoing pet health costs.

Overview of a Structured Settlement Consultant

| Overview of a Structured Settlement Consultant | |

|---|---|

| Role | A Structured Settlement Consultant specializes in advising plaintiffs and defendants on the design and management of structured settlements, ensuring long-term financial security through periodic payments. |

| Expertise | Deep knowledge of legal, financial, and tax implications related to structured settlements, including annuities and settlement planning strategies. |

| Services Provided | Evaluation of settlement options, negotiation assistance, and guidance on payment schedules tailored to meet individual financial needs and objectives. |

| Client Benefits | You gain a clear understanding of settlement terms that align with your financial goals, protecting future income and optimizing tax advantages. |

| Compliance | Ensures all structured settlement arrangements comply with state and federal regulations, safeguarding the interests of all parties involved. |

Key Roles and Responsibilities of Structured Settlement Consultants

Structured Settlement Consultants play a crucial role in guiding clients through complex settlement agreements to maximize financial security and compliance. They offer expert advice tailored to individual needs, ensuring optimal long-term benefits from structured settlements.

- Client Needs Assessment - Evaluate the client's financial goals and legal circumstances to recommend appropriate settlement options.

- Financial Planning Expertise - Provide detailed projections and analysis to help clients understand payment schedules and tax implications.

- Regulatory Compliance Guidance - Ensure all structured settlement agreements meet state and federal legal requirements for validity and fairness.

Essential Skills for Structured Settlement Consultants

Structured settlement consultants must possess strong analytical skills to evaluate complex financial arrangements accurately. Understanding legal and tax implications is crucial for providing tailored advice to clients.

Effective communication skills enable consultants to explain intricate settlement details clearly and build client trust. Attention to detail ensures all aspects of agreements comply with regulatory standards and client needs.

The Importance of Structured Settlement Consultants in Insurance

Structured Settlement Consultants play a crucial role in navigating complex insurance settlements, ensuring clients receive fair and tailored compensation. These experts analyze financial needs and tax implications to design payment plans that provide long-term security. Your well-being depends on their knowledge to maximize benefits and avoid costly mistakes.

How Structured Settlement Consultants Assist Clients

Structured settlement consultants play a crucial role in helping clients navigate complex settlement options. They provide expert guidance to ensure clients receive optimal financial arrangements tailored to their needs.

- Personalized Financial Analysis - Consultants evaluate individual client situations to design structured settlements that maximize long-term financial security.

- Legal and Tax Expertise - They offer detailed insights on legal implications and tax benefits associated with structured settlements.

- Negotiation Assistance - Consultants work with insurers and attorneys to secure favorable settlement terms for their clients.

Educational and Certification Requirements

A Structured Settlement Consultant must possess specialized knowledge in finance, law, and insurance. Formal education often includes a degree in finance, economics, or a related field, establishing a strong foundation for understanding settlement structures.

Certification, such as the Certified Structured Settlement Consultant (CSSC) credential, validates expertise and adherence to industry standards. Your consultant should maintain ongoing education to stay current with regulatory changes and market practices.

Daily Tasks and Challenges of a Structured Settlement Consultant

What are the daily tasks of a Structured Settlement Consultant? A Structured Settlement Consultant evaluates client needs to design customized settlement plans. You manage paperwork, coordinate with insurers and legal teams to ensure compliance and timely payments.

How do Structured Settlement Consultants address client concerns? Consultants explain complex settlement options clearly, ensuring clients understand financial implications. They provide ongoing support to resolve issues and adapt plans when circumstances change.

What challenges do Structured Settlement Consultants face in their role? Balancing legal requirements with client needs requires detailed knowledge and negotiation skills. They must stay updated on regulations while handling multiple cases with varying complexities.

How important is communication in the work of a Structured Settlement Consultant? Effective communication builds trust and clarity between clients, insurers, and attorneys. Consultants frequently translate technical terms into understandable language for informed decision-making.

Why is attention to detail crucial for Structured Settlement Consultants? Accuracy in documentation prevents costly errors and legal complications. Consultants meticulously review financial data and settlement agreements to protect client interests.

Tools and Technologies Used by Structured Settlement Consultants

Structured settlement consultants utilize advanced software platforms to analyze and optimize settlement options, ensuring clients receive the best financial outcomes. They employ data analytics tools to evaluate payment schedules, tax implications, and long-term benefits accurately. Digital communication technologies facilitate seamless interaction with clients, attorneys, and financial institutions throughout the settlement process.

Career Path and Advancement Opportunities

A Structured Settlement Consultant plays a crucial role in helping clients understand and manage insurance settlements. This career offers a unique blend of financial expertise and client advisory skills.

- Entry-Level Opportunities - Positions typically start with training in settlement products and client communication techniques.

- Mid-Level Roles - Consultants often advance to managing larger client portfolios and developing customized settlement plans.

- Senior and Specialized Positions - Experienced consultants may become team leaders, trainers, or move into related fields such as settlement underwriting or claims management.

Structured Settlement Consultants can build a rewarding career with diverse advancement pathways in the insurance industry.

Tips for Excelling as a Structured Settlement Consultant

Structured Settlement Consultants play a crucial role in guiding clients through complex financial decisions. Mastering the nuances of insurance policies and settlement options ensures optimal client outcomes.

Develop deep expertise in tax implications and legal frameworks to provide accurate advice. Build strong communication skills to clearly explain settlement structures and benefits. Focus on personalized solutions that align with each client's unique financial goals.

Related Important Terms

Lump Sum Commutation Analysis

Structured Settlement Consultants specialize in Lump Sum Commutation Analysis by evaluating the present value of future annuity payments to determine optimal buyout offers. This process helps clients make informed decisions by comparing the financial benefits of lump sum settlements versus ongoing periodic payments.

Life Care Plan Integration

Structured settlement consultants specializing in life care plan integration ensure tailored financial solutions that align with long-term medical and personal needs, optimizing settlement funds to cover ongoing healthcare costs effectively. Their expertise bridges the gap between legal settlements and comprehensive care strategies, maximizing the stability and security of beneficiaries facing chronic conditions or disabilities.

Rated Age Underwriting

Rated age underwriting in structured settlement consulting tailors life insurance assessments by adjusting the insured's chronological age to a "rated age" based on health and lifestyle factors, optimizing premium calculations and financial planning. This approach enables consultants to secure more accurate risk evaluations, ensuring settlements are financially sustainable and aligned with individual risk profiles.

Qualified Assignment Corporation (QAC)

A Qualified Assignment Corporation (QAC) serves as a critical intermediary in structured settlements, assuming the obligation to make future periodic payments and relieving defendants or insurers of long-term liabilities. Utilizing a QAC enables efficient transfer of payment responsibilities, ensuring compliance with IRS rules and optimizing tax benefits for all parties involved in structured settlements.

Non-Qualified Structured Settlement Annuities

Non-Qualified Structured Settlement Annuities offer tailored financial solutions for individuals seeking tax-advantaged income streams outside traditional qualified plans, ensuring flexible payment schedules aligned with unique financial goals. Structured Settlement Consultants specialize in analyzing client needs, negotiating terms, and securing optimal non-qualified annuity contracts that enhance long-term financial security.

Structured Settlement Consultant Infographic

jobdayta.com

jobdayta.com