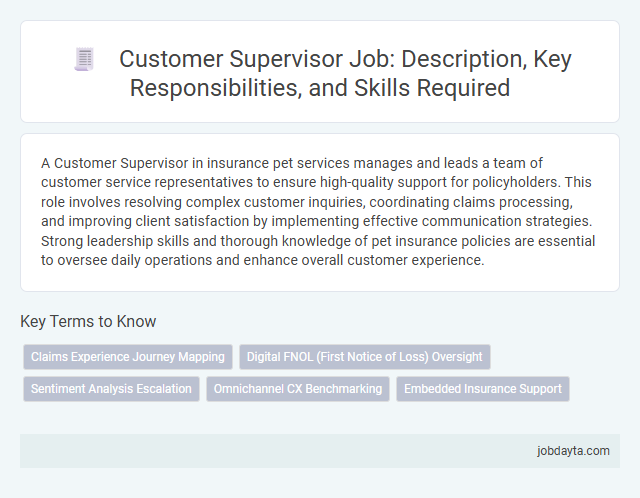

A Customer Supervisor in insurance pet services manages and leads a team of customer service representatives to ensure high-quality support for policyholders. This role involves resolving complex customer inquiries, coordinating claims processing, and improving client satisfaction by implementing effective communication strategies. Strong leadership skills and thorough knowledge of pet insurance policies are essential to oversee daily operations and enhance overall customer experience.

Overview of a Customer Supervisor Role in Insurance

A Customer Supervisor in the insurance industry oversees customer service teams to ensure efficient handling of client inquiries and claims. This role focuses on maintaining high customer satisfaction and compliance with insurance regulations.

- Team Leadership - Guides and supports customer service representatives to deliver accurate and timely assistance.

- Quality Assurance - Monitors interactions and processes to uphold service standards and regulatory compliance.

- Issue Resolution - Manages escalated customer concerns to provide effective and satisfactory solutions.

Key Responsibilities of a Customer Supervisor in the Insurance Sector

A Customer Supervisor in the insurance sector ensures efficient handling of client inquiries and resolves complex issues with professionalism. They lead a team of customer service representatives, providing training and performance evaluations to maintain high service standards. You oversee workflow management and implement strategies to enhance customer satisfaction and retention rates.

Essential Skills Needed for an Insurance Customer Supervisor

| Essential Skills for an Insurance Customer Supervisor |

|---|

| Strong Communication Ability: Clear and effective communication is vital for managing customer inquiries, resolving issues, and providing guidance to the team. |

| Leadership and Team Management: Leading a customer service team requires motivating staff, monitoring performance, and fostering a positive work environment. |

| Problem-Solving Skills: Quickly identifying issues, analyzing customer needs, and implementing solutions maintain high satisfaction levels. |

| Knowledge of Insurance Products: A deep understanding of various insurance policies, claims processes, and regulations ensures accurate customer support. |

| Organizational Skills: Managing multiple cases, prioritizing tasks, and maintaining detailed records supports efficient workflow. |

| Customer-Focused Mindset: Empathy and patience are essential when addressing customer concerns and fostering lasting relationships. |

| Technical Proficiency: Familiarity with customer relationship management (CRM) software and insurance management systems enhances operational efficiency. |

| Attention to Detail: Ensuring accuracy in documentation, policy details, and communication prevents misunderstandings and errors. |

| Conflict Resolution: Managing difficult situations calmly and professionally helps maintain trust and brand reputation. |

| Adaptability: The insurance industry constantly evolves; flexibility allows supervisors to implement new processes and technologies effectively. |

| Your role as a Customer Supervisor demands these critical skills to drive team success and deliver exceptional service in the insurance sector. |

Daily Tasks and Duties of a Customer Supervisor in Insurance

A Customer Supervisor in insurance oversees daily operations within the customer service team to ensure efficient handling of policy inquiries and claims. They monitor service quality, ensuring compliance with regulatory standards and company policies.

The role includes training staff on customer interaction protocols and resolving complex client issues to maintain customer satisfaction. Supervisors also analyze performance metrics to identify areas for improvement and implement workflow enhancements.

How Customer Supervisors Enhance Client Satisfaction in Insurance

Customer Supervisors in insurance play a critical role in ensuring that client concerns are addressed promptly and effectively. They monitor interactions between clients and representatives to maintain high service standards and resolve issues before they escalate. By providing personalized support and continuous communication, Customer Supervisors enhance client satisfaction and build long-term trust in your insurance provider.

Leadership Qualities Required for Insurance Customer Supervisors

What leadership qualities are essential for a Customer Supervisor in the insurance industry? Effective communication and strong decision-making skills enable supervisors to guide teams through complex insurance policies and customer issues. Empathy combined with problem-solving ability ensures customer satisfaction and drives team performance.

Customer Supervisor Job Description: Requirements and Expectations

The Customer Supervisor in the insurance sector oversees client service teams to ensure efficient handling of customer inquiries and claims. This role demands strong leadership skills and in-depth knowledge of insurance products and regulations.

- Team Leadership - Manage and motivate customer service representatives to achieve performance targets and maintain high customer satisfaction.

- Insurance Knowledge - Possess comprehensive understanding of insurance policies, claims processes, and regulatory compliance requirements.

- Communication Skills - Effectively resolve complex customer issues and provide clear guidance to both customers and team members.

Conflict Resolution and Problem-Solving Skills for Insurance Supervisors

Customer Supervisors in the insurance sector play a critical role in managing client relationships and addressing disputes efficiently. Their conflict resolution skills ensure that customer concerns are resolved fairly, maintaining the company's reputation and client trust.

Effective problem-solving abilities enable insurance supervisors to navigate complex claims and policy issues, minimizing delays and misunderstandings. They analyze situations thoroughly to identify root causes and implement practical solutions. These skills contribute to improved customer satisfaction and operational efficiency within insurance companies.

Training and Career Development for Insurance Customer Supervisors

Customer Supervisors in the insurance industry play a pivotal role in ensuring excellent client service and operational efficiency. Comprehensive training programs enhance their skills in risk assessment, claims management, and regulatory compliance.

Focused career development initiatives support Customer Supervisors in advancing to senior management roles within insurance companies. Continuous learning opportunities in insurance products, customer relations, and leadership foster long-term professional growth.

Impact of a Customer Supervisor on Insurance Team Performance

A Customer Supervisor plays a critical role in enhancing the performance of insurance teams by ensuring high-quality customer service and efficient claim handling. Their leadership directly influences team motivation and operational effectiveness.

- Improved Customer Satisfaction - A Customer Supervisor implements coaching strategies that lead to faster claim resolutions and personalized client interactions.

- Enhanced Team Productivity - By monitoring performance metrics, the supervisor identifies training needs and streamlines workflows within the insurance team.

- Risk Management Support - Supervisors ensure compliance with insurance policies and regulatory standards, reducing the risk of errors and disputes.

The presence of a skilled Customer Supervisor drives measurable improvements in insurance team performance and customer retention.

Related Important Terms

Claims Experience Journey Mapping

Customer Supervisors specializing in Claims Experience Journey Mapping analyze policyholder interactions across multiple touchpoints to identify pain points and streamline claims processing. This role enhances customer satisfaction by implementing data-driven improvements that reduce claim resolution time and improve communication transparency.

Digital FNOL (First Notice of Loss) Oversight

Customer Supervisors specializing in Digital FNOL Oversight ensure accurate and timely processing of insurance claims by monitoring first notice of loss submissions across digital platforms. Their role involves optimizing customer experience through real-time validation, fraud detection, and seamless integration with claims management systems to accelerate claim resolution.

Sentiment Analysis Escalation

Customer Supervisors in insurance leverage sentiment analysis escalation tools to identify and address negative customer emotions in real-time, enhancing satisfaction and retention rates. This technology enables proactive intervention by detecting patterns of dissatisfaction, reducing claim resolution times and improving overall service quality.

Omnichannel CX Benchmarking

Customer Supervisors in insurance leverage Omnichannel CX Benchmarking to evaluate and enhance customer interactions across digital, phone, and in-person channels, ensuring consistent service quality and faster claim resolutions. This approach drives higher customer retention rates and empowers teams to address channel-specific pain points through data-driven performance metrics.

Embedded Insurance Support

A Customer Supervisor in Embedded Insurance Support ensures seamless integration of insurance products within partner platforms, enhancing customer experience through real-time assistance and proactive issue resolution. They leverage data analytics and cross-functional collaboration to optimize policy delivery, streamline claims processing, and drive customer satisfaction.

Customer Supervisor Infographic

jobdayta.com

jobdayta.com