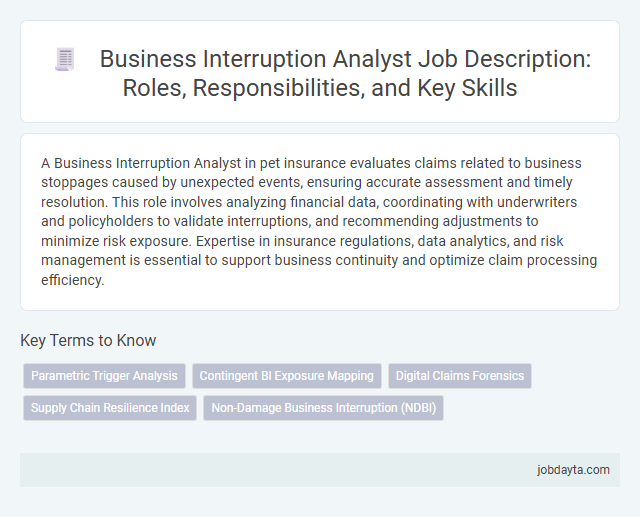

A Business Interruption Analyst in pet insurance evaluates claims related to business stoppages caused by unexpected events, ensuring accurate assessment and timely resolution. This role involves analyzing financial data, coordinating with underwriters and policyholders to validate interruptions, and recommending adjustments to minimize risk exposure. Expertise in insurance regulations, data analytics, and risk management is essential to support business continuity and optimize claim processing efficiency.

Overview of a Business Interruption Analyst Role

A Business Interruption Analyst evaluates the financial impact of unexpected disruptions on a company's operations. This role involves detailed assessment of losses to support insurance claims and risk management strategies.

Responsibilities include analyzing business income statements, estimating period of restoration losses, and collaborating with underwriters and clients to validate claims. The analyst uses financial data and operational reports to calculate damage extent accurately. You play a critical role in ensuring that insurance policies adequately cover potential business interruptions.

Key Responsibilities of a Business Interruption Analyst

A Business Interruption Analyst evaluates the financial impact of disruptions on business operations. They analyze data to assess risks and estimate potential losses during interruption periods.

Key responsibilities include reviewing insurance claims and preparing detailed reports for stakeholders. You ensure accurate loss calculations by collaborating with adjusters, underwriters, and clients to support claim resolutions.

Essential Skills Required for Business Interruption Analysts

Business Interruption Analysts play a critical role in assessing financial impacts caused by disruptions in business operations. Their expertise ensures accurate evaluation and timely recovery support for affected businesses.

- Analytical Skills - Ability to interpret complex financial data and loss reports to determine interruption impact.

- Attention to Detail - Ensures precise documentation and identification of all relevant interruption factors.

- Industry Knowledge - Understanding of various business sectors and insurance policies to evaluate claims accurately.

Understanding Business Interruption Claims Process

What are the key steps involved in the business interruption claims process? The business interruption claims process begins with accurately documenting the loss period and financial impact. This ensures that claims are supported by verifiable data to facilitate timely evaluation and settlement.

How does a business interruption analyst assess the validity of claims? Analysts review policy terms, evaluate financial statements, and verify the cause of interruption against covered perils. Meticulous analysis helps in determining the precise compensation due to the insured.

Why is understanding the documentation requirements crucial for business interruption claims? Proper documentation substantiates the claim and accelerates processing by insurers. It often includes revenue reports, operating expenses, and proof of physical loss or damage.

What role does communication play during the business interruption claims process? Clear communication between the insured, insurer, and analysts helps clarify coverage details and resolve discrepancies. Effective dialogue supports smoother claim resolution and mitigates potential disputes.

How can you prepare to streamline the business interruption claims experience? Maintaining organized financial records and understanding your policy limits can significantly improve claim accuracy. Being proactive enables quicker recovery and reduces business downtime.

Analytical Techniques Used by Business Interruption Analysts

| Analytical Technique | Description | Application in Business Interruption Analysis |

|---|---|---|

| Trend Analysis | Examining historical financial data over a period to identify patterns and anomalies. | Used to forecast potential losses by comparing past revenue trends before and after the interruption event. |

| Ratio Analysis | Calculating financial ratios such as gross profit margin and operating expense ratios. | Helps in assessing the financial health and operating efficiency during the disruption period. |

| Regression Analysis | Statistical method for estimating relationships among variables. | Applied to quantify the impact of specific factors on income loss, isolating variables related to the interruption. |

| Comparative Analysis | Evaluating financial data against industry benchmarks or similar businesses. | Enables validation of loss estimates by comparing to industry norms during similar business interruptions. |

| Cash Flow Modeling | Projecting cash inflows and outflows to estimate the financial impact over time. | Assists in determining the duration and extent of financial loss, critical for claim evaluation. |

| Scenario Analysis | Developing multiple financial scenarios based on differing assumptions or outcomes. | Permits analysis of worst-case, best-case, and most-likely business interruption impacts. |

| Data Visualization | Use of charts, graphs, and dashboards to represent complex financial data clearly. | Facilitates interpretation of loss data and supports effective communication with stakeholders. |

Your understanding of these analytical techniques improves accuracy in calculating business interruption losses and supports strong insurance claim assessments.

Importance of Risk Assessment in Business Interruption Analysis

Business Interruption Analysts play a crucial role in evaluating potential risks that could disrupt your operations and cause financial losses. Comprehensive risk assessment identifies vulnerabilities and measures their potential impact, enabling more accurate forecasting and recovery planning. Understanding these factors helps businesses develop effective strategies to minimize downtime and protect revenue streams.

Collaboration Between Business Interruption Analysts and Insurance Teams

Business Interruption Analysts play a critical role in assessing financial losses during insured event disruptions. Collaboration between these analysts and insurance teams ensures accurate risk evaluation and claims processing. Effective communication streamlines data sharing, resulting in optimized underwriting and timely settlement of business interruption claims.

Tools and Software Commonly Used by Business Interruption Analysts

Business Interruption Analysts rely on specialized software to assess financial losses and analyze operational disruptions during insurance claims. Tools such as RMS RiskLink and AIR Worldwide enable precise risk modeling and scenario analysis.

Spreadsheet software like Microsoft Excel remains essential for detailed data organization and loss calculation. Claims management platforms such as Guidewire and Duck Creek streamline documentation and communication throughout the claims process.

Career Path and Advancement Opportunities in Business Interruption Analysis

Business Interruption Analysts play a crucial role in assessing financial losses resulting from operational disruptions in insured businesses. Career paths in this field offer diverse advancement opportunities through specialization and leadership roles.

- Entry-Level Analyst Positions - Provide foundational experience in evaluating claims and analyzing interruption impacts on business revenue.

- Senior Analyst Roles - Involve leading complex investigations and mentoring junior staff to enhance claim accuracy and efficiency.

- Management and Advisory Careers - Focus on overseeing teams, developing risk mitigation strategies, and advising insurers on policy improvements.

Progression in business interruption analysis demands strong analytical skills, industry knowledge, and continuous professional development.

Challenges Faced by Business Interruption Analysts in the Insurance Industry

Business Interruption Analysts in the insurance industry encounter complex challenges that impact claim accuracy and client satisfaction. These professionals must navigate intricate data, evolving risks, and regulatory constraints to provide precise interruption assessments.

- Complex Data Analysis - Analysts handle vast amounts of financial and operational data to identify accurate loss valuations and interruption periods.

- Dynamic Risk Assessment - Constantly changing business environments require analysts to update risk models and assumptions in real-time.

- Regulatory Compliance - Adhering to diverse and evolving insurance regulations creates added pressure on accurate reporting and claim processing.

Related Important Terms

Parametric Trigger Analysis

Business Interruption Analysts specializing in Parametric Trigger Analysis evaluate predefined parameters such as weather data or seismic activity to swiftly activate insurance claims, minimizing payout delays. Utilizing advanced data modeling and real-time analytics ensures accurate assessment of breach triggers, optimizing risk mitigation for businesses facing operational disruptions.

Contingent BI Exposure Mapping

A Business Interruption Analyst specializing in Contingent Business Interruption (CBI) Exposure Mapping evaluates supply chain vulnerabilities and third-party dependencies to quantify potential financial losses from disruptions. Utilizing advanced risk modeling techniques and geographic information systems, they identify critical nodes and assess the cascading effects on insured business operations.

Digital Claims Forensics

A Business Interruption Analyst specializing in Digital Claims Forensics employs advanced data analytics and forensic technologies to accurately assess the impact of disruptions on insured businesses. Leveraging real-time digital evidence and predictive modeling enhances claim validations, ensuring precise indemnity calculations and mitigating fraudulent activities.

Supply Chain Resilience Index

A Business Interruption Analyst evaluates risks using the Supply Chain Resilience Index to identify vulnerabilities and forecast potential disruptions in supplier networks. This analysis supports insurers in designing tailored coverage that mitigates financial losses from operational delays and supply chain failures.

Non-Damage Business Interruption (NDBI)

A Business Interruption Analyst specializing in Non-Damage Business Interruption (NDBI) evaluates financial losses caused by operational disruptions without physical damage to assets, analyzing supply chain interruptions, cyber incidents, and regulatory changes. Leveraging data modeling and risk assessment tools, they quantify economic impacts and support insurance claims related to NDBI coverage.

Business Interruption Analyst Infographic

jobdayta.com

jobdayta.com