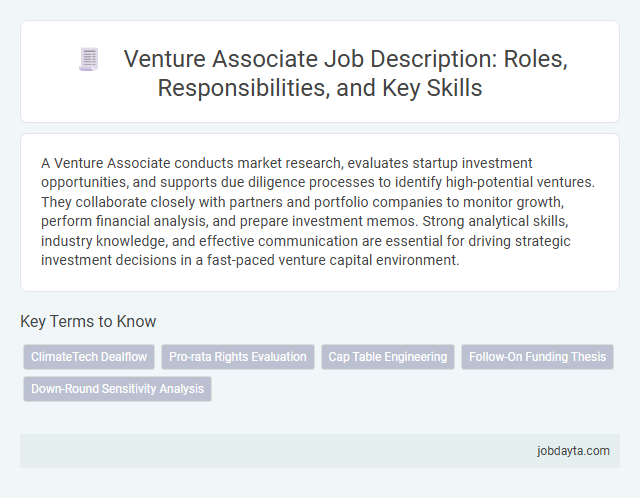

A Venture Associate conducts market research, evaluates startup investment opportunities, and supports due diligence processes to identify high-potential ventures. They collaborate closely with partners and portfolio companies to monitor growth, perform financial analysis, and prepare investment memos. Strong analytical skills, industry knowledge, and effective communication are essential for driving strategic investment decisions in a fast-paced venture capital environment.

Overview of a Venture Associate Role

| Overview of a Venture Associate Role | |

|---|---|

| Role Definition | A Venture Associate supports venture capital firms by identifying promising startups, conducting market research, and assisting in deal execution. |

| Primary Responsibilities | Analyzing business models, evaluating financial metrics, performing due diligence, and managing portfolio communications. |

| Key Skills | Strong financial analysis, market assessment, negotiation, and networking abilities critical for investment decisions. |

| Your Impact | Contributing insights that influence investment strategies and supporting startups' growth within the venture capital ecosystem. |

| Typical Background | Experience in finance, consulting, entrepreneurship, or technology sectors enhances effectiveness as a Venture Associate. |

Key Responsibilities of a Venture Associate

A Venture Associate plays a critical role in supporting investment decisions and managing portfolio companies. Your focus is on analyzing startups, conducting due diligence, and contributing to deal sourcing and execution.

- Market Research and Analysis - Identify emerging trends and evaluate market opportunities to support informed investment strategies.

- Due Diligence - Assess startups' financials, business models, and competitive positioning to ensure sound investment decisions.

- Portfolio Management Support - Collaborate with portfolio companies to track performance and provide strategic insights that drive growth.

Essential Skills for Venture Associates in Finance

Venture Associates in finance require strong analytical skills to evaluate investment opportunities and assess market potential. Proficiency in financial modeling and valuation techniques is crucial for making informed decisions.

Effective communication skills help Venture Associates convey complex financial data clearly to stakeholders and portfolio companies. Networking abilities are essential for sourcing deals and building relationships within the startup ecosystem.

Educational Background and Experience Requirements

A Venture Associate typically holds a bachelor's degree in finance, business administration, economics, or a related field, frequently complemented by an MBA or advanced finance certifications. Your educational background should include strong analytical skills, financial modeling, and market research expertise to succeed in deal evaluation and portfolio management. Experience requirements often involve 2-4 years in venture capital, private equity, investment banking, or startup operations to effectively source deals and support investment decisions.

Daily Tasks and Workflow in Venture Capital

A Venture Associate plays a crucial role in the day-to-day operations of a venture capital firm, supporting investment decisions through detailed market research and data analysis. Their workflow involves coordinating with portfolio companies and evaluating new startup opportunities to align with the firm's strategic goals.

- Market Analysis - Conduct comprehensive research on emerging industries and startups to identify potential investment targets.

- Due Diligence - Evaluate financial statements, business models, and competitive landscapes to assess the viability of investment deals.

- Portfolio Support - Collaborate with portfolio companies to monitor performance metrics and provide operational guidance.

Efficient time management and strong communication skills are essential for a Venture Associate to successfully manage daily tasks and contribute to the venture capital firm's growth.

Critical Competencies for Success in Venture Capital

A Venture Associate plays a vital role in identifying promising startups and conducting thorough market research to support investment decisions. Mastery of financial modeling and valuation techniques is essential for evaluating potential portfolio companies effectively.

Strong analytical skills enable Venture Associates to assess business models, competitive landscapes, and growth potential accurately. Effective communication is crucial for liaising with entrepreneurs and internal teams to align investment strategies. Adaptability and a proactive mindset help them thrive in the fast-paced, ever-evolving venture capital environment.

Collaboration and Networking in Venture Capital Firms

A Venture Associate plays a crucial role in fostering collaboration within venture capital firms, connecting portfolio companies with strategic partners and industry experts. Networking drives deal flow and enhances due diligence by leveraging relationships across the investment ecosystem. Your ability to build and maintain these connections directly impacts sourcing high-potential startups and accelerating growth opportunities.

Impact of a Venture Associate on Investment Decisions

How does a Venture Associate influence investment decisions within a firm? Venture Associates conduct in-depth market research and perform critical financial analyses to identify promising startups. Their insights help shape strategic investment choices that align with the firm's objectives.

What role does a Venture Associate play in evaluating potential investment opportunities? They assess business models, growth potential, and risk factors to determine the viability of each prospect. This rigorous evaluation ensures that your investment portfolio is optimized for maximum returns and impact.

In what ways do Venture Associates contribute to portfolio management after investment? They monitor the performance of portfolio companies and provide ongoing support and guidance to enhance growth trajectories. This active involvement increases the likelihood of achieving successful exits and higher financial gains.

Career Growth and Advancement Opportunities

A Venture Associate in finance plays a crucial role in evaluating startup investments and supporting portfolio companies. This position offers exposure to diverse industries and hands-on experience with innovative business models.

Career growth for Venture Associates typically involves progressing to roles such as Senior Associate, Principal, and eventually Partner. Advancement opportunities depend on deal sourcing, investment performance, and leadership skills within the venture capital ecosystem.

Challenges Faced by Venture Associates in Finance

Venture associates in finance navigate a complex landscape filled with high-stakes decision-making and rapidly evolving market trends. Understanding these challenges is crucial for improving investment strategies and achieving long-term success.

- Information Overload - Venture associates must process vast amounts of data to identify viable investment opportunities and mitigate risks effectively.

- Market Volatility - Constant fluctuations in financial markets complicate accurate valuation and forecasting, impacting investment decisions.

- Deal Sourcing Competition - Securing promising startups requires extensive networking and swift evaluation amidst fierce competition from other investors.

Related Important Terms

ClimateTech Dealflow

A Venture Associate specializing in ClimateTech dealflow identifies high-impact startups advancing sustainable technologies, leveraging data-driven market analysis to source and evaluate investment opportunities aligned with decarbonization trends. They collaborate with industry experts to assess innovation potential, regulatory implications, and scalability, driving strategic investments in next-generation clean energy, carbon capture, and circular economy solutions.

Pro-rata Rights Evaluation

A Venture Associate specializing in pro-rata rights evaluation conducts in-depth analysis to determine the optimal investment scale for maintaining ownership percentage during subsequent funding rounds. This role requires expertise in financial modeling, cap table management, and market trend analysis to accurately forecast dilution impacts and negotiate favorable terms for portfolio companies.

Cap Table Engineering

Venture Associates specializing in Cap Table Engineering optimize ownership structures to maximize startup valuation and investor returns. Precise management of equity distribution, option pools, and convertible instruments ensures balanced stakeholder alignment during funding rounds.

Follow-On Funding Thesis

Venture Associates specializing in Follow-On Funding Thesis prioritize startups with validated product-market fit and consistent revenue growth to optimize portfolio value and mitigate risk. They analyze key performance indicators such as customer acquisition cost (CAC), lifetime value (LTV), and burn rate to inform decisions on subsequent investment rounds.

Down-Round Sensitivity Analysis

Venture Associates conduct down-round sensitivity analysis to evaluate the financial impact of raising capital at a valuation lower than previous funding rounds, assessing dilution effects on ownership percentages and pro-rata rights. This analysis informs strategic decision-making by modeling potential downside scenarios, protecting investor value, and guiding negotiation with stakeholders in venture financing deals.

Venture Associate Infographic

jobdayta.com

jobdayta.com