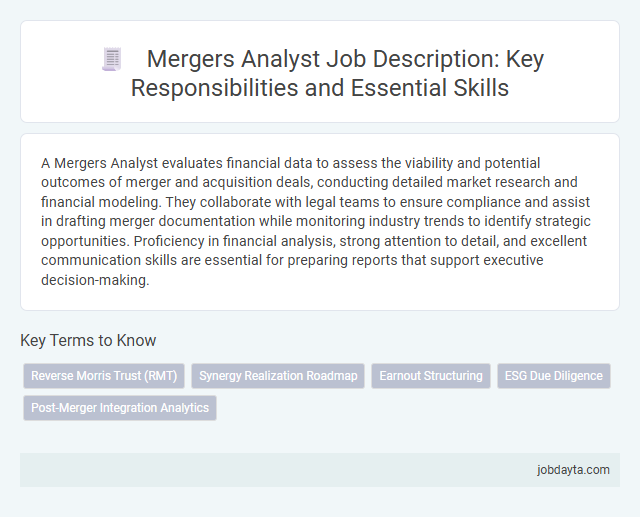

A Mergers Analyst evaluates financial data to assess the viability and potential outcomes of merger and acquisition deals, conducting detailed market research and financial modeling. They collaborate with legal teams to ensure compliance and assist in drafting merger documentation while monitoring industry trends to identify strategic opportunities. Proficiency in financial analysis, strong attention to detail, and excellent communication skills are essential for preparing reports that support executive decision-making.

Overview of a Mergers Analyst Role

A Mergers Analyst plays a crucial role in evaluating and facilitating corporate mergers and acquisitions. Your expertise supports strategic decision-making by analyzing financial data and market trends.

These professionals assess target companies' financial health to identify risks and synergies. They collaborate with legal, financial, and executive teams to structure effective deals. Their analysis ensures value maximization and smooth transaction execution.

- Financial Evaluation - Conduct comprehensive financial modeling and valuation of merger and acquisition targets.

- Due Diligence - Perform detailed analysis of financial statements, market conditions, and operational metrics to assess feasibility and risks.

- Strategic Advisory - Provide insights and recommendations to executive leadership to guide merger decisions and integration plans.

Core Responsibilities of a Mergers Analyst

A Mergers Analyst plays a critical role in evaluating potential merger and acquisition opportunities within the finance sector. This position requires thorough financial modeling and due diligence to assess the viability and strategic fit of proposed deals.

Your core responsibilities include analyzing financial statements, market trends, and competitive landscapes to support decision-making processes. You must also prepare detailed reports and presentations that summarize findings for senior management and stakeholders.

Essential Financial Modeling Skills for Mergers Analysts

Mergers analysts require advanced financial modeling skills to evaluate potential merger and acquisition opportunities accurately. Mastery of discounted cash flow (DCF) analysis and comparable company analysis is essential for assessing deal value and synergy potentials.

Proficiency in Excel, including VBA macros and pivot tables, enhances efficiency in building complex models. Understanding balance sheets, income statements, and cash flow statements allows analysts to forecast post-merger financial performance effectively.

Key Analytical Techniques in Mergers and Acquisitions

What are the key analytical techniques used by mergers analysts in mergers and acquisitions? Mergers analysts primarily utilize financial modeling, including discounted cash flow (DCF) analysis and comparable company analysis, to evaluate potential deals. They also employ synergy estimation and risk assessment to determine the strategic value and feasibility of mergers.

Importance of Due Diligence in Mergers Analysis

Due diligence is a critical process in mergers analysis that ensures all financial, legal, and operational aspects of a target company are thoroughly examined. Mergers analysts rely on due diligence to identify risks, verify assets, and assess the true value of a business before finalizing a deal. Effective due diligence mitigates potential liabilities and supports informed decision-making, ultimately protecting investor interests and maximizing merger success.

Collaboration and Communication Skills for Mergers Analysts

Mergers analysts play a crucial role in evaluating and facilitating corporate mergers by interpreting financial data and market trends. Effective collaboration and communication skills enhance their ability to coordinate between stakeholders and ensure seamless transaction execution.

- Cross-Functional Collaboration - Mergers analysts work closely with legal, financial, and operational teams to align objectives and share critical information.

- Clear Financial Reporting - Communicating complex financial insights in a concise manner supports informed decision-making during merger negotiations.

- Stakeholder Engagement - Maintaining open dialogue with clients and executives builds trust and fosters transparency throughout the merger process.

Tools and Software Commonly Used by Mergers Analysts

| Tool/Software | Description | Key Features | Use in Mergers Analysis |

|---|---|---|---|

| Microsoft Excel | Widely used spreadsheet software for data analysis and financial modeling. | Pivot tables, advanced formulas, VBA scripting, data visualization. | Building financial models, scenario analysis, valuation calculations. |

| Capital IQ | Research platform providing financial data on public and private companies. | Comprehensive financials, transaction database, market data, screening tools. | Conducting comparable company analysis, precedent transaction analysis, market research. |

| Bloomberg Terminal | Real-time financial data and news service. | Market data, news alerts, analytics, communication tools. | Monitoring market trends, deal tracking, competitive intelligence. |

| Dealogic | Integrated platform for managing mergers and acquisitions deals. | Pipeline tracking, market intelligence, performance analytics. | Managing deal flow, analyzing industry trends, performance benchmarking. |

| FactSet | Financial data and analytics platform. | Market data, powerful screening, financial modeling tools. | Valuation support, market research, peer analysis. |

| Merrill Datasite | Virtual data room for secure document sharing during due diligence. | Document control, audit trails, Q&A management. | Supporting secure due diligence process during mergers and acquisitions. |

| PowerPoint | Presentation software used for deal summaries and pitchbooks. | Slide design, charts and graphs, custom templates. | Preparing presentations for stakeholders, deal proposals, management briefings. |

| Tableau | Data visualization tool for creating interactive dashboards. | Drag-and-drop interface, advanced charts, real-time data connectivity. | Visualizing financial data, trend analysis, portfolio monitoring. |

Required Educational Background and Certifications

Mergers Analysts play a crucial role in evaluating and facilitating business mergers and acquisitions. Their expertise relies heavily on a strong educational foundation and relevant professional certifications.

- Bachelor's Degree in Finance, Economics, or Business Administration - This degree provides essential knowledge in financial analysis, market dynamics, and corporate strategy.

- Master's Degree or MBA - Advanced degrees enhance analytical skills and strategic understanding, increasing your competitiveness in the field.

- Certifications such as CFA or CPA - These credentials validate your expertise in financial reporting, valuation, and investment analysis critical for mergers.

Securing these educational qualifications and certifications positions you for success as a Mergers Analyst.

Career Path and Advancement Opportunities for Mergers Analysts

Mergers Analysts play a crucial role in assessing potential mergers and acquisitions, analyzing financial statements, and evaluating market trends. Their expertise supports strategic decisions that drive business growth and value creation.

The career path for Mergers Analysts typically begins with entry-level analyst roles, progressing to senior analyst positions as experience deepens. Advancement opportunities include moving into associate or vice president roles in investment banking or corporate development. Strong analytical skills and a solid understanding of financial modeling enhance your prospects for promotion and leadership roles.

Challenges Faced by Mergers Analysts in the Finance Sector

Mergers analysts in the finance sector face the challenge of accurately valuing companies amid volatile market conditions and incomplete data. They must navigate complex regulatory environments and ensure compliance with antitrust laws while managing tight deadlines. Your ability to synthesize financial models and assess strategic fit is critical to overcoming these obstacles and delivering precise merger evaluations.

Related Important Terms

Reverse Morris Trust (RMT)

Mergers analysts specializing in Reverse Morris Trust (RMT) transactions evaluate complex corporate restructurings where a parent company spins off a subsidiary and immediately merges it with a target company to achieve tax-efficient asset divestitures. Their expertise involves detailed financial modeling, assessing tax implications, and ensuring regulatory compliance to optimize shareholder value and transaction success.

Synergy Realization Roadmap

A Mergers Analyst specializing in Synergy Realization Roadmaps evaluates integration opportunities to maximize cost savings and revenue enhancements post-merger. This role involves detailed financial modeling and cross-functional collaboration to track synergy milestones and ensure alignment with strategic objectives.

Earnout Structuring

Mergers Analysts specializing in earnout structuring design performance-based payment frameworks that align post-acquisition incentives between buyers and sellers. They leverage financial modeling and due diligence to quantify contingent payments, ensuring risk mitigation and value optimization throughout deal negotiations.

ESG Due Diligence

Mergers analysts specializing in ESG due diligence evaluate environmental, social, and governance risks to ensure sustainable value creation during mergers and acquisitions. Their expertise includes analyzing carbon footprint data, labor practices, regulatory compliance, and governance structures to identify potential liabilities and growth opportunities.

Post-Merger Integration Analytics

Post-Merger Integration Analysts leverage advanced data analytics to monitor synergy realization, cost savings, and operational efficiencies, ensuring alignment with strategic objectives. Utilizing predictive modeling and performance metrics, they identify integration risks and opportunities to optimize value creation during merger transitions.

Mergers Analyst Infographic

jobdayta.com

jobdayta.com