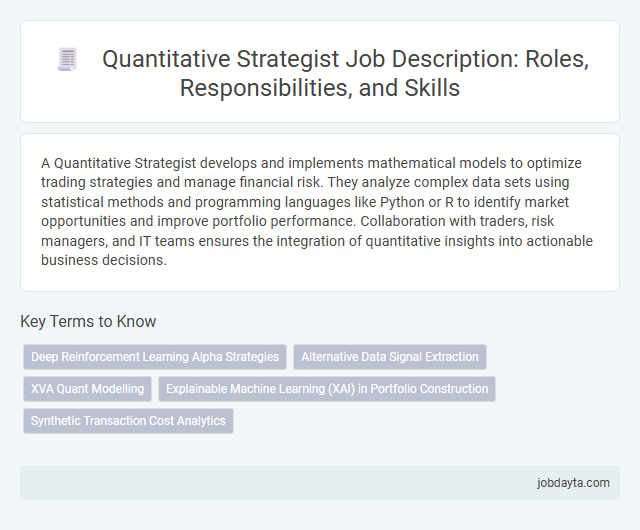

A Quantitative Strategist develops and implements mathematical models to optimize trading strategies and manage financial risk. They analyze complex data sets using statistical methods and programming languages like Python or R to identify market opportunities and improve portfolio performance. Collaboration with traders, risk managers, and IT teams ensures the integration of quantitative insights into actionable business decisions.

Overview of a Quantitative Strategist Role

A Quantitative Strategist applies mathematical models and statistical techniques to develop trading strategies and manage financial risks. Their work involves analyzing large datasets to identify market trends and optimize investment portfolios.

They collaborate with traders, researchers, and technology teams to implement algorithmic trading solutions. Expertise in programming, finance, and data science is essential for success in this role.

Key Responsibilities of a Quantitative Strategist

Quantitative Strategists develop mathematical models to analyze financial markets and optimize investment strategies. They employ statistical techniques and programming skills to interpret complex data sets and identify profitable opportunities.

You design algorithms that enhance trading efficiency and risk management. Collaboration with traders and portfolio managers ensures your strategies align with market conditions and business objectives.

Essential Skills for Quantitative Strategists in Finance

| Essential Skills for Quantitative Strategists in Finance | |

|---|---|

| Mathematical Proficiency | Expertise in calculus, linear algebra, probability, and statistics is crucial for developing quantitative models and risk assessments. |

| Programming Skills | Fluency in programming languages such as Python, R, C++, and MATLAB enables implementation of algorithms and data analysis. |

| Data Analysis and Manipulation | Ability to work with large datasets, perform cleaning, transformation, and exploratory data analysis to extract insights. |

| Financial Market Knowledge | Understanding of financial instruments, market microstructure, trading strategies, and portfolio management principles is essential. |

| Machine Learning and Statistical Modeling | Competence in applying regression, classification, clustering, and time series forecasting models improves prediction accuracy and strategy development. |

| Risk Management | Skills in measuring and managing financial risk, including credit risk, market risk, and operational risk, support decision-making processes. |

| Problem-Solving and Critical Thinking | Strong analytical mindset aids in identifying inefficiencies and optimizing trading strategies and models. |

| Communication Skills | Ability to explain complex quantitative concepts clearly to both technical and non-technical stakeholders enhances collaboration. |

| Attention to Detail | Precision in data handling, coding, and model validation prevents costly errors in financial analysis and strategy execution. |

Educational Requirements for Quantitative Strategist Positions

Quantitative Strategists typically require advanced degrees in fields such as finance, mathematics, statistics, or computer science. Proficiency in programming languages like Python, R, or C++ is essential for developing and implementing complex financial models. Candidates with strong analytical skills and experience in data analysis or machine learning often have a competitive advantage in securing these roles.

Tools and Technologies Used by Quantitative Strategists

Quantitative strategists leverage advanced tools and technologies to develop data-driven financial models. These resources enable precise market analysis and robust risk management strategies.

- Programming Languages - Python, R, and MATLAB are essential for statistical analysis and algorithm development in quantitative finance.

- Data Platforms - Platforms like Bloomberg Terminal and Reuters Eikon provide real-time financial data and analytics crucial for informed decision-making.

- Machine Learning Frameworks - TensorFlow and PyTorch facilitate the creation of predictive models to enhance trading strategies and portfolio management.

Your proficiency with these tools directly impacts the effectiveness of your quantitative strategies.

Importance of Data Analysis and Modeling in Quantitative Strategy

Quantitative strategists leverage data analysis to identify patterns and optimize financial decision-making processes. Modeling plays a crucial role in predicting market trends and managing investment risks effectively.

- Data-Driven Insights - Quantitative strategists use statistical and machine learning techniques to extract actionable insights from vast financial datasets.

- Risk Assessment - Accurate modeling enables the assessment and mitigation of investment risks through scenario analysis and stress testing.

- Algorithmic Trading - Advanced quantitative models power algorithmic trading strategies that execute trades based on predictive analytics and market signals.

Career Path and Growth Opportunities for Quantitative Strategists

Quantitative strategists play a critical role in finance by developing mathematical models to drive investment decisions and risk management. Career paths in this field offer dynamic growth opportunities through exposure to advanced analytics and financial technologies.

- Entry-Level Roles - Start as analysts or junior quantitative researchers, focusing on data analysis and model development.

- Mid-Level Advancement - Progress to senior quantitative strategist positions, leading complex projects and collaborating with portfolio managers.

- Leadership Opportunities - Move into management or specialized expert roles, influencing firm-wide trading strategies and innovation.

Challenges Faced by Quantitative Strategists in Financial Markets

Quantitative strategists navigate complex financial markets by developing mathematical models to predict market movements and optimize investment strategies. Challenges include handling vast datasets, ensuring model robustness amid market volatility, and integrating emerging technologies like machine learning without overfitting. Your success depends on balancing quantitative precision with practical market insights to sustain competitive advantage.

How Quantitative Strategists Impact Investment Decisions

How do Quantitative Strategists influence investment decisions? Quantitative Strategists analyze vast datasets using statistical models to identify market trends and investment opportunities. Their insights enable portfolio managers to make data-driven decisions that enhance risk-adjusted returns.

Tips for Writing an Effective Quantitative Strategist Job Description

Crafting a clear and targeted job description is essential for attracting skilled Quantitative Strategists. Highlight core responsibilities such as developing mathematical models and analyzing financial data to inform investment decisions.

Include required technical skills like proficiency in programming languages (Python, R, MATLAB) and a strong foundation in statistics and machine learning. Emphasize experience with financial markets, risk management, and quantitative research methodologies. Outline key personal attributes such as analytical thinking, attention to detail, and strong communication skills to ensure effective collaboration with cross-functional teams.

Related Important Terms

Deep Reinforcement Learning Alpha Strategies

Quantitative strategists specializing in deep reinforcement learning develop alpha strategies by leveraging neural networks to optimize portfolio allocations and dynamic trading decisions. These models continuously learn from market data patterns, enhancing predictive accuracy and generating consistent excess returns in complex financial environments.

Alternative Data Signal Extraction

Quantitative strategists specializing in alternative data signal extraction leverage machine learning algorithms and advanced statistical models to identify actionable trading patterns from non-traditional data sources such as satellite imagery, social media sentiment, and transaction records. Their expertise in parsing diverse datasets enhances predictive accuracy, driving alpha generation and informed investment decision-making in hedge funds and asset management firms.

XVA Quant Modelling

Quantitative strategists specializing in XVA quant modeling develop advanced valuation adjustment frameworks incorporating credit, funding, and collateral risk to optimize derivative pricing and risk management. They leverage stochastic models, Monte Carlo simulations, and machine learning algorithms to enhance accuracy in bilateral counterparty risk assessment and regulatory capital computations.

Explainable Machine Learning (XAI) in Portfolio Construction

Quantitative strategists leverage Explainable Machine Learning (XAI) techniques to enhance portfolio construction by improving model transparency and interpretability, enabling more informed investment decisions. This approach helps identify key risk factors and asset correlations, optimizing asset allocation while maintaining compliance with regulatory requirements.

Synthetic Transaction Cost Analytics

Quantitative strategists specializing in synthetic transaction cost analytics develop advanced models to simulate and predict trading expenses, enhancing execution strategies and minimizing market impact. Their expertise integrates high-frequency data analysis, algorithmic trading insights, and sophisticated cost metrics to optimize portfolio performance and improve decision-making in dynamic financial markets.

Quantitative Strategist Infographic

jobdayta.com

jobdayta.com