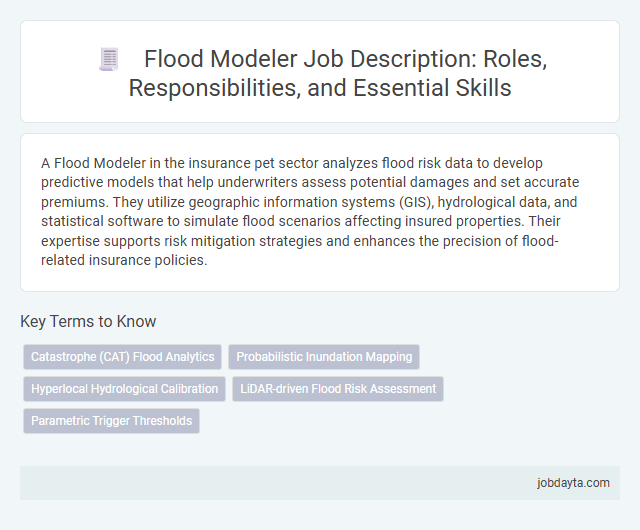

A Flood Modeler in the insurance pet sector analyzes flood risk data to develop predictive models that help underwriters assess potential damages and set accurate premiums. They utilize geographic information systems (GIS), hydrological data, and statistical software to simulate flood scenarios affecting insured properties. Their expertise supports risk mitigation strategies and enhances the precision of flood-related insurance policies.

Overview of a Flood Modeler in Insurance

A Flood Modeler plays a crucial role in insurance by assessing flood risk through advanced data analysis and simulation techniques. This tool helps insurers evaluate potential flood damage to properties, enhancing risk management strategies.

Flood Modelers use geographic information systems (GIS), historical flood data, and hydrological modeling to predict flood extents and depths. These models aid in determining insurance premiums, underwriting decisions, and claims processing. By leveraging accurate flood risk assessments, your insurance coverage becomes more tailored and reliable.

Key Roles and Responsibilities of a Flood Modeler

A Flood Modeler plays a critical role in the insurance industry by analyzing flood risks using advanced hydrological and hydraulic modeling techniques. Their expertise supports accurate risk assessment and pricing of insurance policies related to flood hazards.

- Risk Analysis - Conducts detailed flood risk assessments to predict potential flood impact on properties and infrastructure.

- Model Development - Develops and validates flood models that simulate flood scenarios based on geographical and meteorological data.

- Data Integration - Integrates diverse data sources such as rainfall patterns, topography, and historical flood events to enhance model accuracy.

Effective flood modeling enables insurers to manage exposure and optimize coverage strategies in flood-prone areas.

Essential Skills for Effective Flood Modeling

Flood modeling requires a deep understanding of hydrology, hydraulics, and geographic information systems (GIS). Accurate data analysis and simulation skills are essential to predict flood behavior and assess risk zones effectively.

Proficiency in software tools such as HEC-RAS and GIS platforms enhances model precision and usability. Strong analytical abilities combined with knowledge of local climate patterns improve the reliability of flood risk assessments for insurance purposes.

Tools and Software Used by Flood Modelers

Flood modelers rely on advanced tools and software to accurately predict flood risks and assess potential damages. Key software includes HEC-RAS, MIKE FLOOD, and FLO-2D, which integrate hydrologic and hydraulic data for detailed simulations. Your ability to interpret outputs from these platforms ensures effective risk management and informed decision-making.

Importance of Flood Modeling in Insurance Risk Assessment

Flood modeling plays a crucial role in insurance risk assessment by providing detailed analysis of potential flood hazards and their impact on properties. Accurate flood models help insurers estimate the likelihood and severity of flood events, enabling precise premium calculations and efficient risk management. Your ability to leverage advanced flood modeling ensures better protection and financial stability against flood-related damages.

Data Collection and Analysis Techniques for Flood Modeling

| Aspect | Details |

|---|---|

| Flood Modeler Overview | Flood modeling simulates water movement and predicts flood extents, depth, and duration. It supports risk assessment for insurance underwriting and claims management. |

| Data Collection Techniques |

|

| Analysis Techniques |

|

| Importance for Insurance | Accurate flood modeling informs risk-based premium settings, underwriting decisions, and claims forecasting. Your insurance strategy benefits from robust data collection and advanced analytical methods to mitigate flood-related losses. |

Collaboration with Underwriters and Risk Managers

Flood Modeler enhances collaboration between underwriters and risk managers by providing precise flood risk assessments using advanced data analytics. This tool enables real-time sharing of risk insights, facilitating informed decision-making in insurance underwriting.

Underwriters gain detailed exposure reports, while risk managers utilize predictive modeling to develop mitigation strategies. Integration of Flood Modeler into workflows fosters a unified approach to managing flood-related insurance risks effectively.

Challenges Faced by Flood Modelers in Insurance

What are the primary challenges faced by flood modelers in the insurance industry? Flood modelers struggle with the lack of high-resolution and up-to-date hydrological data, which limits the accuracy of flood risk predictions. The complexity of climate change impacts and urban development further complicate model calibration and risk assessment.

How does data variability impact flood modeling for insurance purposes? Inconsistent historical flood data and varying local conditions create uncertainty in probabilistic flood models. This uncertainty affects insurers' ability to set precise premiums and reserves, increasing financial risk.

Why is integrating climate change projections challenging for flood modelers? Climate models vary widely in predicting extreme weather events, making it difficult to produce reliable flood forecasts. The evolving nature of climate data demands constant model adjustments, increasing operational costs.

What role does urban expansion play in complicating flood risk models? Rapid urbanization alters natural water drainage patterns, which many models fail to capture in real time. This leads to underestimated flood risk in newly developed areas, impacting insurance underwriting accuracy.

How do regulatory constraints affect the development of flood models? Flood modeling must comply with diverse regional regulations and reporting standards, limiting model flexibility. Navigating these constraints requires additional resources and specialized expertise.

Educational and Professional Qualifications for Flood Modelers

Flood Modelers require specialized education and professional skills to accurately assess flood risks and support insurance underwriting. Your qualifications must combine technical knowledge with practical experience in hydrology and geographic information systems.

- Bachelor's Degree in Hydrology or Environmental Science - Foundational knowledge in water systems and environmental processes is essential for flood modeling.

- Proficiency in GIS and Remote Sensing Technologies - Skills in geographic information systems enable detailed flood mapping and risk analysis.

- Certification in Flood Risk Modeling or Related Fields - Professional certifications validate expertise and adherence to industry standards in flood risk assessment.

Career Growth and Opportunities in Flood Modeling within Insurance

Flood modeling plays a critical role in the insurance industry by assessing flood risks and guiding underwriting decisions. This specialized field offers significant career growth opportunities due to increasing climate uncertainty and technological advancements.

- Rising Demand for Expertise - Insurance companies require skilled flood modelers to improve risk assessment and reduce claim losses from natural disasters.

- Technological Integration - Proficiency in GIS, remote sensing, and hydraulic modeling tools boosts career prospects within flood risk analysis roles.

- Impact on Business Strategy - Your insights as a flood modeler influence premium pricing, policy development, and regulatory compliance in insurance underwriting.

Related Important Terms

Catastrophe (CAT) Flood Analytics

Flood Modeler leverages advanced catastrophe (CAT) flood analytics to assess flood risks with precision, integrating hydrological data, historical flood events, and climate projections for accurate loss estimation. This sophisticated analytics tool enhances underwriting decisions, portfolio risk management, and regulatory compliance by providing real-time flood hazard mapping and scenario analysis.

Probabilistic Inundation Mapping

Flood Modeler utilizes probabilistic inundation mapping to assess flood risk by simulating thousands of potential flood scenarios, generating detailed probability maps that highlight varying depths and extents of water coverage. This approach enables insurers to quantify exposure accurately, optimize underwriting decisions, and price flood insurance policies based on precise risk assessments.

Hyperlocal Hydrological Calibration

Flood Modeler utilizes hyperlocal hydrological calibration to enhance flood risk assessments by incorporating highly detailed watershed data and localized precipitation patterns. This precision allows insurers to more accurately predict flood zones and potential damage, optimizing underwriting processes and risk management strategies.

LiDAR-driven Flood Risk Assessment

LiDAR-driven flood risk assessment utilizes high-resolution topographic data to create precise flood models that identify vulnerable areas and improve floodplain mapping accuracy. This technology enhances insurance underwriting by enabling detailed analysis of flood hazards, supporting risk mitigation strategies and accurate premium pricing.

Parametric Trigger Thresholds

Flood modeler parametric trigger thresholds define specific water level or rainfall measurements that activate automatic insurance payouts without traditional claims processing. These thresholds streamline flood risk assessment and enable faster, transparent compensation based on pre-defined flood intensity parameters.

Flood Modeler Infographic

jobdayta.com

jobdayta.com