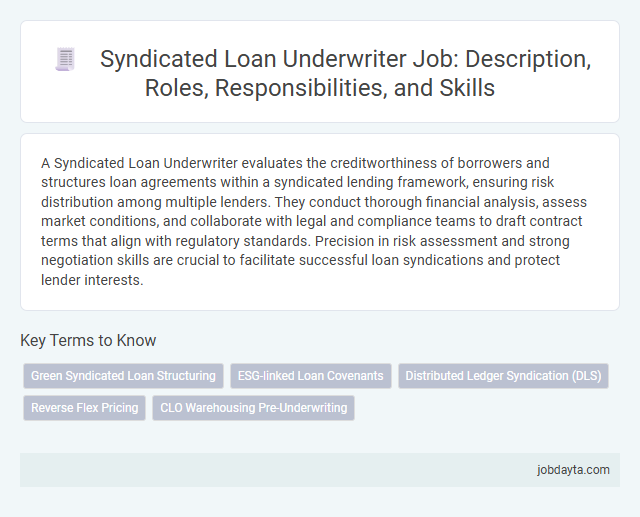

A Syndicated Loan Underwriter evaluates the creditworthiness of borrowers and structures loan agreements within a syndicated lending framework, ensuring risk distribution among multiple lenders. They conduct thorough financial analysis, assess market conditions, and collaborate with legal and compliance teams to draft contract terms that align with regulatory standards. Precision in risk assessment and strong negotiation skills are crucial to facilitate successful loan syndications and protect lender interests.

Introduction to Syndicated Loan Underwriting in Finance

Syndicated loan underwriting plays a crucial role in large-scale corporate financing. It involves multiple lenders pooling resources to provide substantial credit to a single borrower.

- Syndicated Loan Underwriter - An entity that organizes and structures the loan, coordinating between the borrower and participating lenders.

- Risk Distribution - Spreads credit risk among multiple financial institutions, reducing exposure for each participant.

- Financial Expertise - Requires in-depth analysis of creditworthiness, market conditions, and borrower's financial health to price the loan appropriately.

Effective underwriting ensures loan syndication success and strengthens lender-borrower relationships in complex financing deals.

Key Responsibilities of a Syndicated Loan Underwriter

The key responsibilities of a syndicated loan underwriter include conducting thorough credit analysis and risk assessment to evaluate the borrower's financial health. They structure loan agreements, negotiate terms with multiple lenders, and ensure compliance with regulatory standards. This role requires close collaboration with investment banks, legal teams, and syndicate members to successfully distribute the loan across financial institutions.

Essential Skills for Successful Syndicated Loan Underwriters

Syndicated loan underwriters require strong analytical skills to assess credit risk and evaluate borrower financials accurately. Proficiency in financial modeling and market analysis enables them to structure loan agreements that balance risk and return effectively. Effective communication and negotiation skills are vital to coordinate among multiple lenders and ensure successful loan syndication.

The Role of Syndicated Loan Underwriters in Financial Institutions

Syndicated loan underwriters play a critical role in financial institutions by assessing and structuring large loan packages that are distributed among multiple lenders. Their expertise ensures risk is managed effectively while meeting the borrowing needs of corporations and governments.

You rely on syndicated loan underwriters to conduct thorough credit analysis, negotiate terms, and coordinate between participating banks. These professionals facilitate collaboration, enabling financial institutions to share risk and provide substantial funding in complex financing deals.

Step-by-Step Process of Syndicated Loan Underwriting

Syndicated loan underwriting involves a group of lenders pooling resources to fund large-scale loans. The underwriter coordinates the process, assessing risks and structuring the loan terms.

The first step is conducting thorough credit analysis of the borrower, evaluating financial statements and market conditions. Next, the underwriter designs the loan structure, determining tranche amounts, interest rates, and repayment schedules.

After structuring, the underwriter prepares the syndication strategy, identifying potential participant banks. They then present the loan package to prospective lenders to secure commitments and distribute risks effectively.

Once the syndicate is formed, the underwriter finalizes legal documentation and ensures regulatory compliance. Your role is crucial in monitoring loan performance and managing communication among all parties during the loan term.

Risk Assessment and Analysis in Syndicated Loan Underwriting

Risk assessment and analysis are critical components of syndicated loan underwriting, ensuring the viability and security of multi-lender financing arrangements. Thorough evaluation of creditworthiness, market conditions, and borrower profile helps mitigate potential losses in complex loan syndications.

- Credit Risk Evaluation - In-depth analysis of the borrower's financial health and repayment capacity determines the likelihood of default.

- Market Risk Analysis - Assessment of economic and industry trends identifies external factors that may affect loan performance.

- Risk Allocation Among Lenders - Structuring the loan with appropriate risk-sharing mechanisms protects all participating financial institutions involved in the syndicate.

Collaboration Between Syndicated Loan Underwriters and Lending Teams

Syndicated loan underwriters play a crucial role in structuring and distributing large loan facilities among multiple lenders. Their collaboration with lending teams ensures efficient risk assessment and optimal allocation of capital.

- Enhanced Risk Management - Syndicated loan underwriters work closely with lending teams to identify and mitigate credit risks across participating financial institutions.

- Streamlined Communication - Continuous coordination between underwriters and lending teams facilitates clear information sharing and alignment on loan terms and conditions.

- Optimized Loan Structuring - Joint efforts enable tailored loan packages that meet borrower needs while balancing lender requirements, enhancing deal success rates.

Career Path and Growth Opportunities as a Syndicated Loan Underwriter

| Career Path | Syndicated Loan Underwriters typically begin as financial analysts or credit analysts within banking institutions. Entry-level roles involve assessing borrower creditworthiness and conducting preliminary risk analysis. Progression leads to positions as junior underwriters, where professionals participate in structuring loan syndication deals and interacting with multiple lenders. Mid-level underwriters gain expertise in managing syndication processes, coordinating with legal teams, and conducting detailed financial modeling. Senior roles include overseeing large syndicated loan portfolios, leading due diligence efforts, and advising on credit terms. Experienced underwriters may advance to managerial positions such as Head of Loan Syndication or Director of Credit Risk. |

|---|---|

| Growth Opportunities | Syndicated Loan Underwriters benefit from career growth through specialization in sectors like energy, infrastructure, or real estate finance, enhancing market knowledge and deal acumen. Professional certifications such as CFA (Chartered Financial Analyst) or credit-focused training improve expertise and employability. Growth prospects include transitioning into relationship management or credit risk management roles, providing broader exposure to client engagement and portfolio strategy. Networking within syndication syndicates and investment banks expands career mobility and access to high-value transactions. Advancement often involves developing leadership skills, mastering regulatory compliance, and adopting innovative credit risk assessment tools, positioning underwriters for executive roles in corporate banking or financial institutions. |

Challenges Faced by Syndicated Loan Underwriters in Today’s Market

Syndicated loan underwriters navigate complex regulatory environments and heightened compliance requirements that demand meticulous attention to detail. Market volatility and fluctuating credit conditions increase the risk associated with structuring and distributing syndicated loans.

Managing diverse borrower profiles and coordinating among multiple lenders require advanced risk assessment and effective communication strategies. The pressure to balance borrower needs with investor expectations intensifies due diligence processes and loan documentation efforts. Your ability to adapt to evolving market dynamics directly impacts the success of syndicated loan underwriting.

Tools and Technologies Used by Syndicated Loan Underwriters

What tools and technologies do syndicated loan underwriters utilize to manage complex financing deals? Syndicated loan underwriters rely on advanced financial modeling software and risk assessment platforms to evaluate borrower creditworthiness and structure loan agreements efficiently. These technologies enable precise cash flow analysis and real-time collaboration among multiple lending institutions.

How do data analytics tools enhance the decision-making process for syndicated loan underwriters? Through predictive analytics and big data integration, underwriters gain insights into market trends, borrower behavior, and potential risks. These data-driven tools support your ability to optimize loan syndication strategies and improve portfolio management.

Which communication technologies are essential for syndicated loan underwriting teams? Secure digital platforms, such as encrypted email systems and virtual data rooms, facilitate confidential information sharing between underwriters, borrowers, and syndicate members. These tools streamline negotiations and document management, ensuring compliance with regulatory requirements.

Related Important Terms

Green Syndicated Loan Structuring

Green syndicated loan structuring involves coordinating multiple lenders to finance environmentally sustainable projects, ensuring compliance with green finance principles and achieving optimal risk distribution. Syndicated loan underwriters assess ESG risks, structure credit facilities aligned with green bond standards, and facilitate transparency through rigorous due diligence and reporting frameworks.

ESG-linked Loan Covenants

Syndicated loan underwriters integrating ESG-linked loan covenants enhance sustainability criteria by embedding environmental, social, and governance performance metrics into credit agreements, aligning borrower incentives with responsible business practices. This approach drives improved risk management, attracts ESG-focused investors, and supports market demand for transparent, impact-driven financing solutions in syndicated lending.

Distributed Ledger Syndication (DLS)

Syndicated loan underwriters leverage Distributed Ledger Syndication (DLS) to enhance transparency, reduce settlement times, and streamline syndicate communication through blockchain technology. DLS enables secure real-time tracking of loan commitments and allocations, improving efficiency and risk management across multiple financial institutions.

Reverse Flex Pricing

Syndicated loan underwriters implement reverse flex pricing to adjust interest spreads downward when investor demand exceeds initial expectations, optimizing loan syndication efficiency. This pricing mechanism incentivizes participation by reducing borrowing costs, enhancing deal marketability, and aligning investor appetite with issuer funding requirements.

CLO Warehousing Pre-Underwriting

Syndicated loan underwriters play a critical role in CLO warehousing pre-underwriting by evaluating credit quality, structuring tranche levels, and ensuring compliance with regulatory standards to optimize asset allocation and risk profiles. Their expertise enables efficient capital deployment and accurate pricing models, which enhance investor confidence and facilitate secondary market liquidity.

Syndicated Loan Underwriter Infographic

jobdayta.com

jobdayta.com