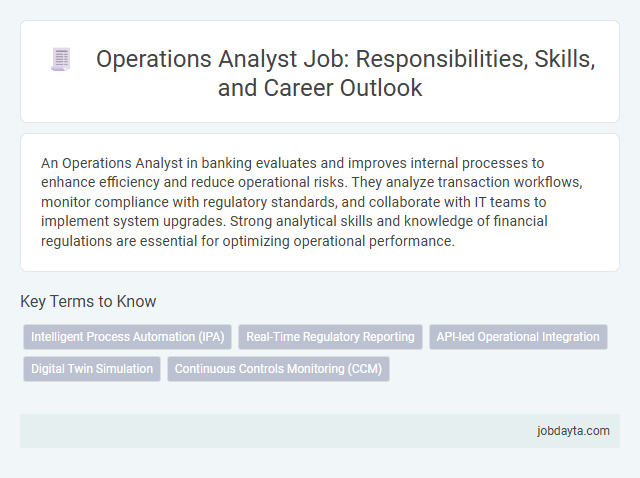

An Operations Analyst in banking evaluates and improves internal processes to enhance efficiency and reduce operational risks. They analyze transaction workflows, monitor compliance with regulatory standards, and collaborate with IT teams to implement system upgrades. Strong analytical skills and knowledge of financial regulations are essential for optimizing operational performance.

Overview of Operations Analyst Role in Banking

An Operations Analyst in banking plays a critical role in optimizing and streamlining financial processes. They analyze transaction data and operational workflows to enhance efficiency and reduce risks.

This role involves monitoring daily banking operations, ensuring compliance with regulatory standards, and identifying process improvements. Operations Analysts use data analytics tools to detect discrepancies and support decision-making. Their efforts contribute to minimizing errors and improving customer satisfaction within the banking environment.

Key Responsibilities of a Banking Operations Analyst

A Banking Operations Analyst plays a critical role in streamlining banking processes and ensuring operational efficiency. Your expertise supports accurate transaction processing and risk management.

- Data Analysis and Reporting - Analyze banking transactions and operational data to identify trends and generate detailed performance reports.

- Process Improvement - Develop and implement strategies to optimize workflow, reduce errors, and enhance service delivery.

- Compliance Management - Ensure all banking operations adhere to regulatory requirements and internal policies to mitigate risks.

Essential Skills Required for Operations Analysts

What essential skills are crucial for an Operations Analyst in banking? Strong analytical abilities and attention to detail are fundamental for managing complex financial data. Effective communication skills enable clear reporting and collaboration across departments.

How important is problem-solving for an Operations Analyst? You must identify inefficiencies and develop strategic solutions to optimize operational workflows. Proficiency in data analysis tools like Excel and SQL supports informed decision-making.

Which technical skills should an Operations Analyst possess? Expertise in process improvement methodologies such as Lean or Six Sigma enhances productivity. Familiarity with banking software and regulatory compliance ensures smooth operations and risk mitigation.

Why is time management critical in this role? Managing multiple projects and deadlines requires prioritization and organizational skills. Efficient time management leads to improved accuracy and consistent performance in fast-paced environments.

How does teamwork impact an Operations Analyst's effectiveness? Collaboration with cross-functional teams drives successful project execution. Your ability to work well with others fosters a cohesive and productive banking environment.

Typical Daily Tasks and Workflow

| Role | Operations Analyst |

|---|---|

| Department | Banking Operations |

| Typical Daily Tasks |

|

| Workflow |

|

Importance of Compliance and Risk Management

Operations Analysts play a critical role in banking by ensuring all processes adhere to regulatory compliance standards. They monitor transactions and internal controls to minimize the risk of financial crimes and operational failures.

Effective compliance and risk management protect banks from penalties and reputational damage. These analysts implement frameworks that identify, assess, and mitigate risks, safeguarding both the institution and its customers.

Tools and Technologies Used by Operations Analysts

Operations Analysts in banking leverage advanced tools and technologies to optimize process efficiency and ensure regulatory compliance. Mastery of data analysis platforms and automation software is essential for their effective performance.

- Data Analysis Software - Tools like SQL, Python, and Excel enable Analysts to process large datasets for accurate trend identification and decision-making.

- Robotic Process Automation (RPA) - Platforms such as UiPath and Blue Prism streamline repetitive tasks, reducing errors and improving workflow automation.

- Enterprise Resource Planning (ERP) Systems - Solutions including SAP and Oracle facilitate end-to-end process management and real-time operational monitoring in banking environments.

Career Path and Advancement Opportunities

Operations Analysts in banking play a crucial role in streamlining processes and ensuring efficient transaction management. Career advancement typically progresses from entry-level analyst to senior analyst, with opportunities to move into roles such as Operations Manager or Risk Analyst. Specialized skills in data analysis, regulatory compliance, and financial technology enhance progression prospects within leading banking institutions.

Educational Background and Certifications Needed

An Operations Analyst in banking typically holds a bachelor's degree in finance, business administration, or economics. Advanced degrees such as an MBA can enhance career prospects and analytical skills.

Certifications like Certified Business Analysis Professional (CBAP) or Certified Operations Manager (COM) are highly valued. Proficiency in data analysis tools and knowledge of regulatory compliance are essential for success in this role.

Challenges Faced by Operations Analysts in Banking

Operations Analysts in banking encounter complex challenges such as managing large volumes of transactional data while ensuring accuracy and compliance with regulatory standards. They must swiftly identify process inefficiencies and implement solutions that reduce operational risk without disrupting customer service. Your role demands constant adaptation to evolving financial technologies and stringent security protocols to maintain seamless operations.

Future Outlook and Industry Trends for Operations Analysts

The role of an Operations Analyst in banking is evolving rapidly due to technological advancements and increasing regulatory demands. Future outlook highlights growing opportunities in process automation, data analytics, and risk management.

- Automation Integration - Operations Analysts will increasingly implement robotic process automation to enhance efficiency and reduce manual errors.

- Data-Driven Decision Making - Advanced data analytics tools will enable more precise operational insights and strategic planning.

- Regulatory Compliance Focus - Heightened regulatory scrutiny requires Analysts to ensure adherence to complex financial regulations and mitigate operational risks.

Operations Analysts who adapt to emerging technologies and regulatory changes will play a crucial role in modernizing banking operations.

Related Important Terms

Intelligent Process Automation (IPA)

Operations Analysts specializing in Intelligent Process Automation (IPA) leverage advanced robotic process automation (RPA) tools and AI-driven analytics to streamline banking workflows, reduce operational risks, and enhance transaction processing efficiency. Their expertise in automating repetitive tasks and integrating machine learning algorithms significantly improves data accuracy and accelerates compliance reporting within financial institutions.

Real-Time Regulatory Reporting

Operations Analysts specializing in Real-Time Regulatory Reporting monitor and analyze transaction data to ensure compliance with evolving financial regulations, leveraging automated systems to detect discrepancies promptly. Their expertise in data integrity and regulatory frameworks supports timely submission of accurate reports to regulatory bodies, mitigating risk and enhancing operational efficiency.

API-led Operational Integration

An Operations Analyst specializing in API-led operational integration enhances banking workflows by streamlining data exchange between core systems, reducing manual intervention and increasing transaction accuracy. This role leverages API frameworks and real-time analytics to optimize process efficiency, ensuring seamless integration across payments, compliance, and customer service platforms.

Digital Twin Simulation

Operations Analysts specializing in Digital Twin Simulation utilize advanced modeling techniques to replicate banking processes, enabling precise forecasting and optimization of transaction workflows. Leveraging real-time data integration, they identify operational inefficiencies and design actionable strategies to enhance customer experience and reduce processing times in digital banking environments.

Continuous Controls Monitoring (CCM)

Operations Analysts specializing in Continuous Controls Monitoring (CCM) leverage advanced analytics and automation tools to detect and prevent transactional anomalies in real-time, enhancing risk management and regulatory compliance within banking operations. Their expertise in monitoring control design effectiveness and implementing corrective actions reduces operational errors, strengthens internal controls, and supports audit readiness.

Operations Analyst Infographic

jobdayta.com

jobdayta.com