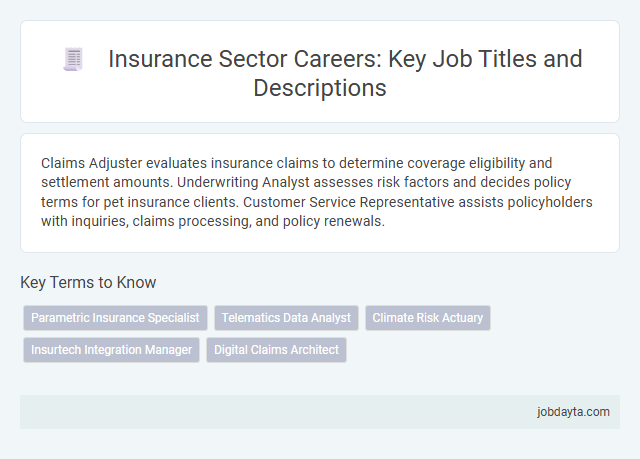

Claims Adjuster evaluates insurance claims to determine coverage eligibility and settlement amounts. Underwriting Analyst assesses risk factors and decides policy terms for pet insurance clients. Customer Service Representative assists policyholders with inquiries, claims processing, and policy renewals.

Overview of the Insurance Sector

The insurance sector encompasses a broad range of specialized job titles reflecting diverse roles and responsibilities. Key positions include Claims Adjuster, Risk Analyst, Underwriting Manager, Policy Advisor, and Actuarial Scientist. These roles drive risk assessment, policy development, customer support, and financial analysis within the industry.

Common Career Paths in Insurance

The insurance industry offers a wide range of career opportunities catering to diverse skill sets. Common career paths include roles that combine analytical abilities with customer service expertise.

Key job titles in the insurance sector include Claims Adjuster, Risk Analyst, Underwriting Manager, and Policy Advisor. These positions play vital roles in evaluating risk, managing policies, and ensuring client satisfaction. Professionals often progress from entry-level roles like Insurance Agent to specialized positions such as Actuarial Scientist or Compliance Officer.

Insurance Underwriter: Role and Responsibilities

What does an Insurance Underwriter do in their daily role? An Insurance Underwriter evaluates risks and determines the terms of insurance policies. They analyze data and decide whether to approve or reject applications based on risk assessments.

How does an Insurance Underwriter impact the insurance company's profitability? By accurately assessing risk levels, the underwriter ensures that policies are priced correctly to balance competitive premiums with company risk exposure. Their decisions protect the insurer from unnecessary losses while offering fair coverage.

What skills are essential for an Insurance Underwriter? Analytical skills and attention to detail are crucial for evaluating complex risk factors. Strong communication skills help underwriters explain policy terms clearly to clients and agents.

Why is decision-making critical for an Insurance Underwriter? Each underwriting decision affects policy acceptance and company risk management. Sound judgment ensures underwriting guidelines are followed, minimizing potential claims and financial losses.

How does technology influence the role of an Insurance Underwriter? Advanced software tools assist in risk assessment and automate data analysis, increasing efficiency. Technology enables underwriters to process applications faster while maintaining accuracy.

Claims Adjuster: Key Functions Explained

Claims Adjusters play a vital role within the insurance industry by investigating and evaluating insurance claims. Their work ensures accurate settlements and protects both the insurer and policyholder interests.

- Investigation - Examines the details of a claim to verify its validity and assess the extent of the insurer's liability.

- Evaluation - Determines the value of damages or loss based on policy terms and evidence gathered.

- Settlement Negotiation - Communicates with claimants and other parties to agree on fair compensation amounts.

Your claims will be handled efficiently and transparently to facilitate timely resolution.

Actuary: Skills and Job Description

Actuaries analyze statistical data to assess risk and uncertainty in the insurance industry. Key skills include proficiency in mathematics, statistics, and financial theory, along with expertise in predictive modeling and risk management. Your role as an actuary involves developing strategies that ensure financial stability and help insurance companies set accurate premiums.

Insurance Sales Agent: Duties and Career Growth

Insurance Sales Agents play a crucial role in connecting clients with suitable insurance policies. They assess client needs, explain coverage options, and recommend appropriate plans to ensure financial protection.

Career growth in this field often leads to positions such as Senior Sales Agent, Sales Manager, or Insurance Broker. Gaining experience and professional certifications can enhance earning potential and open opportunities for leadership roles within the insurance industry.

Risk Manager: Essential Job Insights

The role of a Risk Manager in the insurance sector is pivotal for identifying and mitigating potential threats to business stability. Your expertise helps safeguard assets and ensure regulatory compliance.

- Risk Assessment - Analyzes exposure to financial and operational risks to inform management decisions.

- Compliance Oversight - Ensures all insurance policies meet legal standards and internal policies.

- Strategic Planning - Develops risk mitigation frameworks tailored to market and organizational needs.

Insurance Analyst: What to Expect

Insurance Analysts play a crucial role in the insurance industry by evaluating risk factors and analyzing data to support underwriting decisions. They utilize statistical models and market trends to forecast potential claims and assess policy profitability.

Expect to work closely with actuaries, underwriters, and claims specialists to provide insights that guide strategic planning. Strong analytical skills and proficiency with insurance software and data analysis tools are essential for success in this role.

Customer Service Roles in Insurance

| Job Title | Description |

|---|---|

| Customer Service Representative | Handles client inquiries, processes claims, and provides policy information. |

| Client Support Specialist | Offers technical assistance and support for insurance products and services. |

| Claims Service Assistant | Processes claim documentation and communicates with policyholders regarding claims status. |

| Policy Service Advisor | Provides guidance on policy coverage options and updates to existing insurance policies. |

| Customer Experience Manager | Develops strategies to improve client satisfaction and service quality in insurance operations. |

| Service Coordinator | Organizes customer service activities and coordinates between departments to resolve issues. |

| Client Relations Manager | Maintains strong relationships with policyholders and addresses their insurance service needs. |

| Retention Specialist | Focuses on reducing policy cancellations and improving customer loyalty in insurance portfolios. |

| Insurance Customer Advocate | Represents policyholders in dispute resolutions and promotes customer rights within insurance firms. |

| Contact Center Agent | Responds to inbound calls regarding insurance quotes, coverage, and claims support. |

Emerging Careers in the Insurance Industry

The insurance industry is evolving rapidly with new roles that blend technology, data science, and risk management. Emerging careers offer innovative opportunities to shape the future of insurance your expertise can propel these advancements forward.

- Data Scientist - Utilizes big data analytics to predict risks and enhance underwriting processes.

- Cybersecurity Analyst - Protects insurance companies from digital threats and secures sensitive client information.

- Claims Automation Specialist - Develops AI-driven systems to streamline and accelerate claim settlements.

Related Important Terms

Parametric Insurance Specialist

Parametric Insurance Specialists design and manage policies that trigger automatic payouts based on predefined parameters such as weather events or natural disasters. Their expertise enhances risk assessment accuracy and accelerates claim settlements within the insurance industry.

Telematics Data Analyst

Telematics Data Analyst in insurance leverages vehicle and driver data to assess risk, optimize premiums, and enhance claims accuracy. Utilizing advanced analytics and IoT-generated telematics data, they improve underwriting processes and support fraud detection efforts.

Climate Risk Actuary

Climate Risk Actuary specializes in quantifying and modeling the financial impact of climate-related risks on insurance portfolios, leveraging advanced statistical techniques and climate science data. Their expertise supports insurers in developing adaptive premium strategies and risk mitigation plans to address evolving environmental threats.

Insurtech Integration Manager

Insurtech Integration Managers oversee the seamless incorporation of digital technologies within traditional insurance processes, enhancing operational efficiency and customer experience. They coordinate between IT teams, insurance stakeholders, and technology vendors to implement innovative solutions such as AI-driven claims processing and blockchain-based policy management.

Digital Claims Architect

Digital Claims Architects design and implement innovative technology frameworks to streamline claims processing and improve customer experience in insurance companies. Their expertise in data integration and automation drives operational efficiency and enhances fraud detection capabilities.

Sure, here’s a non-exhaustive but highly focused list of real, two-word or more job titles found in Infographic

jobdayta.com

jobdayta.com