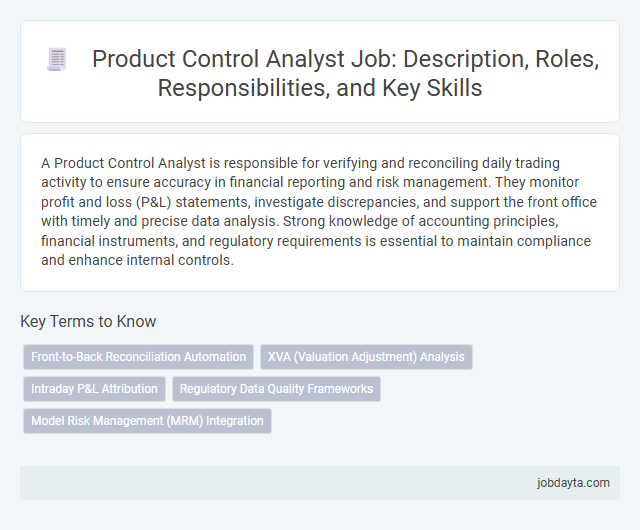

A Product Control Analyst is responsible for verifying and reconciling daily trading activity to ensure accuracy in financial reporting and risk management. They monitor profit and loss (P&L) statements, investigate discrepancies, and support the front office with timely and precise data analysis. Strong knowledge of accounting principles, financial instruments, and regulatory requirements is essential to maintain compliance and enhance internal controls.

Overview of Product Control Analyst Role in Banking

The Product Control Analyst plays a crucial role in ensuring the accuracy of financial reporting within banking institutions. Your responsibilities focus on validating trading data and supporting risk management through detailed analysis.

- Financial Data Validation - Ensures the integrity of trading and profit & loss (P&L) data across banking products.

- Risk and Compliance Support - Collaborates with risk management teams to maintain regulatory compliance and identify inconsistencies.

- Reporting and Analysis - Prepares detailed reports on financial performance, supporting decision-making and strategy formulation.

Key Responsibilities of a Product Control Analyst

| Key Responsibilities of a Product Control Analyst |

|---|

| Monitor daily profit and loss (P&L) for trading desks ensuring accuracy and compliance with accounting standards. |

| Reconcile trading activity with the general ledger to maintain proper financial records and support financial reporting. |

| Perform detailed analysis of position valuations, identifying pricing discrepancies and ensuring timely issue resolution. |

| Collaborate with front office, risk management, and finance teams to validate trade capture and valuation methodologies. |

| Prepare daily and monthly P&L reports highlighting drivers behind profit fluctuations and unusual transactions. |

| Support month-end and quarter-end financial close processes through accurate P&L and balance sheet reporting. |

| Ensure compliance with regulatory requirements by maintaining transparent audit trails for all product control activities. |

| Provide insights and recommendations based on financial data and control analyses to inform business decisions. |

| You will play a critical role in maintaining financial integrity and risk management across multiple trading products. |

Essential Skills for Product Control Analysts

Product Control Analysts play a crucial role in ensuring the accuracy and integrity of financial information within banking institutions. Mastering specific skills enhances your ability to manage risks and support strategic decision-making efficiently.

- Financial Reporting Expertise - Proficiency in preparing and reconciling daily P&L and balance sheet reports ensures accurate financial data representation.

- Risk Management Knowledge - Understanding market, credit, and operational risks supports effective control and mitigation strategies.

- Advanced Analytical Skills - Ability to analyze complex data sets and perform variance analysis aids in identifying inconsistencies and trends quickly.

Strong communication and collaboration skills are essential for working effectively with traders, finance teams, and senior management.

Educational and Professional Qualifications

Strong educational qualifications are essential for a Product Control Analyst, typically requiring a bachelor's degree in finance, accounting, economics, or a related field. Professional certifications such as CFA, CPA, or ACCA enhance credibility and expertise in financial analysis and risk management. Your background should demonstrate proficiency in financial reporting, regulatory compliance, and advanced Excel and accounting software skills.

Daily Tasks and Workflow in Product Control

What are the core daily tasks of a Product Control Analyst in banking? You monitor and validate daily trading profits and losses to ensure accuracy. Your role includes reconciling trade data and investigating discrepancies promptly.

Which workflow steps are essential for effective Product Control operations? Recording and reconciling financial transactions regularly supports precise financial reporting. Collaborating with traders and finance teams helps streamline issue resolution.

How does a Product Control Analyst manage risk through daily activities? You analyze valuation adjustments and market movements affecting product portfolios. Continuous review of risk factors ensures compliance with regulatory standards.

What tools are commonly used in the daily workflow of Product Control Analysts? Financial software like Bloomberg and Excel supports data analysis and reporting tasks. Automated reconciliation platforms enhance efficiency and accuracy in data verification.

How does communication impact your daily workflow as a Product Control Analyst? Efficient interaction with front office and middle office teams resolves pricing and booking issues. Clear reporting keeps stakeholders informed on daily P&L fluctuations.

Importance of Product Control in Financial Institutions

Product Control plays a crucial role in financial institutions by ensuring accurate valuation of trading portfolios and verifying profit and loss reports. This function supports risk management and regulatory compliance, safeguarding the institution's financial integrity.

Accurate product control enhances decision-making by providing transparent and reliable financial data. It bridges the gap between front office trading activities and back office accounting, ensuring consistency and preventing financial misstatements.

Reporting and Compliance Duties

The Product Control Analyst plays a critical role in ensuring accurate financial reporting within the banking sector. This position focuses on verifying trade data integrity and supporting regulatory compliance obligations.

Key responsibilities include preparing daily and monthly P&L reports, ensuring alignment with accounting standards, and identifying discrepancies in valuation processes. The analyst collaborates with front office teams to validate trade bookings and mitigate financial risks. Strong knowledge of IFRS, GAAP, and Basel III regulatory frameworks is essential for maintaining compliance and enhancing reporting accuracy.

Tools and Software Used by Product Control Analysts

Product Control Analysts rely heavily on advanced financial software and data analytics tools to ensure accurate valuation and risk assessment of trading products. Key platforms include Excel with VBA for customized reporting and Python for automated data analysis, enhancing efficiency in daily reconciliations.

Specialized software such as Bloomberg Terminal and Reuters Eikon provide real-time market data essential for product pricing and control. Risk management systems like Murex and Calypso support comprehensive exposure tracking and compliance monitoring, enabling precise financial oversight within banking operations.

Career Path and Advancement Opportunities

Product Control Analysts play a crucial role in ensuring accurate financial reporting and risk management within banking institutions. Career advancement often involves progressing to senior analyst roles, risk management, or finance leadership positions such as Finance Manager or Head of Product Control. Your skills in analytics, communication, and regulatory compliance open pathways to specialized roles or strategic decision-making positions in the bank's finance division.

Challenges Faced by Product Control Analysts

Product Control Analysts play a crucial role in ensuring accurate financial reporting and risk management within banking institutions. Facing complex data and tight deadlines, they must maintain precision in highly dynamic environments.

- Data Accuracy Pressure - Ensuring flawless reconciliation between trading activities and accounting records demands rigorous attention to detail.

- Regulatory Compliance - Adhering to constantly evolving financial regulations requires continuous monitoring and adaptation.

- Time-sensitive Reporting - Delivering timely valuation reports and profit and loss analysis challenges your ability to balance speed with accuracy.

Related Important Terms

Front-to-Back Reconciliation Automation

Product Control Analysts specializing in Front-to-Back Reconciliation Automation leverage advanced technologies such as robotic process automation (RPA) and AI-driven analytics to streamline the verification of trading activities and financial reporting. This optimization reduces operational risk, enhances data accuracy, and ensures compliance with regulatory standards across the full trade lifecycle.

XVA (Valuation Adjustment) Analysis

Product Control Analysts specializing in XVA perform critical valuation adjustment analysis to assess counterparty credit risk, funding costs, and market risk impacts on derivative portfolios. They leverage advanced quantitative models and financial data to ensure accuracy in XVA metrics, enhancing risk management and regulatory compliance in banking operations.

Intraday P&L Attribution

A Product Control Analyst specializing in Intraday P&L Attribution ensures accurate real-time profit and loss tracking by analyzing trading activities and market movements throughout the day. They utilize advanced financial models and data analytics to identify discrepancies, validate valuations, and support risk management within the bank's trading portfolio.

Regulatory Data Quality Frameworks

Product Control Analysts ensure accuracy and compliance within Banking by validating financial data against Regulatory Data Quality Frameworks such as BCBS 239 and MiFID II. They implement controls to monitor data integrity, minimize risk, and support regulatory reporting requirements.

Model Risk Management (MRM) Integration

Product Control Analysts specializing in Model Risk Management (MRM) Integration ensure accurate valuation and risk assessment of complex financial models by validating assumptions and testing model outputs against market data. Their expertise bridges front-office trading activities with risk functions, enhancing regulatory compliance and supporting strategic decision-making through robust model governance and control frameworks.

Product Control Analyst Infographic

jobdayta.com

jobdayta.com