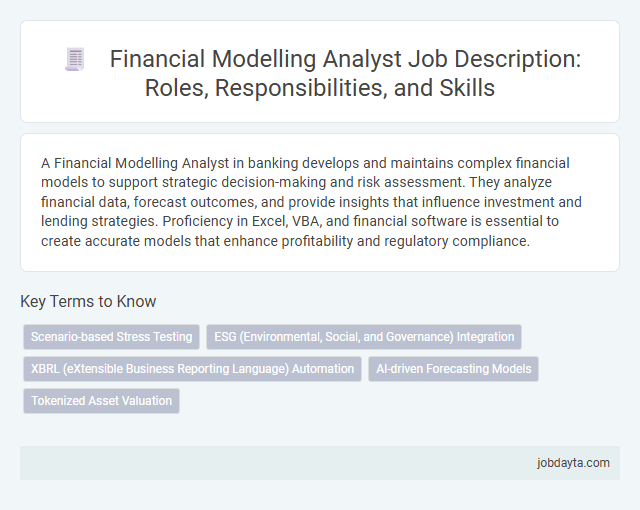

A Financial Modelling Analyst in banking develops and maintains complex financial models to support strategic decision-making and risk assessment. They analyze financial data, forecast outcomes, and provide insights that influence investment and lending strategies. Proficiency in Excel, VBA, and financial software is essential to create accurate models that enhance profitability and regulatory compliance.

Overview of Financial Modelling Analyst Role in Banking

A Financial Modelling Analyst in banking specializes in creating detailed financial models to support decision-making and risk assessment. The role involves analyzing complex data sets, forecasting financial performance, and evaluating investment opportunities. Your expertise helps banks optimize strategies and enhance financial stability through accurate projections and scenario analysis.

Key Responsibilities of a Financial Modelling Analyst

A Financial Modelling Analyst plays a crucial role in developing detailed financial models to support banking decisions. Your expertise helps in forecasting, risk analysis, and strategic planning within the financial sector.

- Financial Model Development - Create and maintain complex financial models to evaluate investment opportunities and business performance.

- Data Analysis - Analyze historical financial data and market trends to provide accurate projections and insights.

- Reporting and Presentation - Prepare detailed reports and presentations to communicate findings and support decision-making processes.

Essential Skills Required for Financial Modelling Analysts

Financial Modelling Analysts in banking require a precise set of skills to evaluate financial data and forecast business performance. Mastering these abilities ensures accurate and insightful financial models that support strategic decision-making.

- Advanced Excel Proficiency - Expertise in Excel functions, pivot tables, and macros enables complex financial data manipulation and model building.

- Strong Analytical Skills - The ability to interpret financial statements and market trends ensures robust scenario analysis and risk assessment.

- Understanding of Accounting Principles - Comprehensive knowledge of GAAP or IFRS provides a solid foundation for accurate financial representation in models.

Importance of Financial Modelling in Banking Sector

Financial modelling in the banking sector is crucial for accurate risk assessment and strategic decision-making. It enables banks to evaluate credit risks, project cash flows, and optimize capital allocation effectively.

Robust financial models support regulatory compliance by forecasting potential market fluctuations and stress testing portfolios. These models enhance the ability to make informed lending and investment decisions based on quantitative data. Your role as a Financial Modelling Analyst ensures the bank's financial stability and growth through precise data-driven insights.

Educational Qualifications and Certifications Needed

Financial Modelling Analysts in banking typically require a bachelor's degree in finance, economics, accounting, or a related field to build a strong foundation in financial principles. Professional certifications such as the Chartered Financial Analyst (CFA) or Certified Financial Modeller (CFM) enhance credibility and demonstrate advanced expertise in financial analysis and modelling techniques. Advanced skills in Excel, VBA, and financial software like MATLAB or Python are often essential for creating accurate and dynamic financial models used in banking decision-making.

Tools and Software Commonly Used by Financial Modelling Analysts

Financial Modelling Analysts in banking rely heavily on specialized tools and software to construct accurate predictive models. Mastery of these tools enhances your ability to analyze complex financial data and support strategic decision-making.

- Microsoft Excel - The foundational tool for building detailed financial models using advanced formulas, pivot tables, and macros.

- VBA (Visual Basic for Applications) - Used to automate repetitive tasks within Excel, improving model efficiency and accuracy.

- Financial Modelling Software (e.g., Quantrix, Palisade) - Provides enhanced capabilities for scenario analysis and risk assessment beyond traditional spreadsheets.

Proficiency in these tools ensures robust and scalable financial models that drive performance insights in banking.

Typical Career Path for Financial Modelling Analysts in Banking

What is the typical career path for a Financial Modelling Analyst in banking? Financial Modelling Analysts usually start as junior analysts, developing skills in Excel, VBA, and financial statement analysis. They progress to senior analyst roles, leading complex model projects and collaborating with investment teams to optimize financial strategies.

How does career advancement occur for Financial Modelling Analysts in banking? Advancement often involves specializing in areas like risk management, mergers and acquisitions, or corporate finance. Experienced analysts may move into managerial positions, overseeing teams or transitioning into strategic advisory roles within the bank.

Challenges Faced by Financial Modelling Analysts

Financial Modelling Analysts encounter complex data integration challenges when consolidating diverse financial inputs. Accurate forecasting demands thorough understanding of market dynamics and economic variables.

Maintaining model accuracy under rapidly changing regulations requires constant updates and scenario analysis. Your ability to interpret evolving compliance standards directly impacts decision-making quality.

How Financial Modelling Analysts Contribute to Decision-Making

| Role | Financial Modelling Analyst |

|---|---|

| Primary Function | Develop detailed financial models to analyze banking data, forecast financial outcomes, and assess risks. |

| Contribution to Decision-Making | Financial Modelling Analysts provide critical insights by transforming complex financial data into actionable models. These models support strategic planning, capital allocation, and risk management within banking institutions. Their expertise enables management to evaluate potential investments, loan portfolios, and market scenarios effectively. |

| Impact Areas |

|

| Your Benefit | You gain clarity and confidence in financial decisions, supported by robust, data-driven models that minimize uncertainty. |

Salary Expectations and Job Market Trends for Financial Modelling Analysts

Financial Modelling Analysts play a critical role in the banking sector, utilizing quantitative skills to forecast financial performance and support strategic decision-making. Salary expectations for these professionals typically range from $70,000 to $120,000 annually, influenced by experience, education, and geographic location.

Job market trends indicate a growing demand for Financial Modelling Analysts driven by increased reliance on data analytics and risk assessment in banking institutions. Certifications such as CFA and advanced proficiency in Excel, VBA, and Python enhance job prospects and salary potential in this evolving market.

Related Important Terms

Scenario-based Stress Testing

A Financial Modelling Analyst specializing in Scenario-based Stress Testing develops dynamic models to evaluate banks' resilience under adverse economic conditions, incorporating variables such as interest rate shocks, credit defaults, and liquidity crunches. These stress tests provide critical insights into potential capital shortfalls, risk exposures, and regulatory compliance, enabling proactive risk management and strategic decision-making.

ESG (Environmental, Social, and Governance) Integration

A Financial Modelling Analyst specializing in ESG integration develops quantitative models to assess environmental, social, and governance risks and opportunities impacting investment portfolios and corporate valuations. Expertise in sustainable finance metrics, carbon footprint analysis, and regulatory compliance enables accurate forecasting of ESG factors' financial implications within banking risk management and asset allocation.

XBRL (eXtensible Business Reporting Language) Automation

Financial Modelling Analysts specializing in XBRL Automation leverage advanced scripting and data integration techniques to streamline the extraction and validation of structured financial data, enhancing accuracy in regulatory reporting and compliance. Expertise in XBRL taxonomies facilitates the transformation of complex financial disclosures into machine-readable formats, significantly reducing manual errors and accelerating decision-making processes in banking institutions.

AI-driven Forecasting Models

Financial Modelling Analysts specializing in AI-driven forecasting models utilize machine learning algorithms and big data analytics to enhance predictive accuracy for banking risk assessment, asset valuation, and market trend analysis. These advanced models enable financial institutions to optimize decision-making processes, improve portfolio management, and mitigate potential losses by forecasting economic variables with greater precision.

Tokenized Asset Valuation

Financial Modelling Analysts specializing in tokenized asset valuation utilize advanced quantitative techniques and blockchain data to create accurate pricing models for digital securities. Their expertise integrates on-chain metrics, market volatility, and regulatory frameworks to enhance asset liquidity forecasts and investment risk assessments.

Financial Modelling Analyst Infographic

jobdayta.com

jobdayta.com